Real estate investors are constantly on the lookout for ways to maximize their property’s cash flow and return on equity. One way to maximize cash flow is to “buy up” to a larger property to increase both your cash flow and available tax-sheltering depreciation. The key to this strategy is to employ a tax-deferred IRC 1031 Exchange. Instead of paying tax on the gain and depreciation recapture resulting from your property sale, an IRC 1031 Exchange defers the tax and keeps all your dollars working for you – essentially creating an interest-free loan from the government, so long as investment real estate continues to be held.

A Brief History of IRC 1031 Exchanges

You may be asking yourself – why would the federal government allow such an investor-friendly opportunity to be included in the Internal Revenue Code? The history of IRC 1031 began nearly 100 years ago, when tax-deferred exchanges were first mentioned in the Revenue Act of 1921. At that time, it was not uncommon for property to be traded for other property. Since no economic benefit was realized when property was swapped for property, the exchange was not considered to be a taxable event. Soon thereafter, in 1924, the code was amended to allow only “Like-Kind Exchanges”, disallowing exchanges between different asset classes such as personal property for real estate.

The next 60 years were quiet as it relates to 1031 Exchange legislation until 1984 when Delayed Exchanges (traditional exchanges with a 45-day identification period and 180-day close period) were approved. In the years following 1984, the code has been clarified and modified to allow for Reverse Exchanges and exchanges to and from both Tenant-In-Common (TIC) and Delaware Statutory Trust (DST) ownership structures. As a result of the Tax Cuts and Jobs Act of 2017, the code was further amended to disallow all property other than real estate to be exchanged. This served to solidify real estate as truly a unique asset class with significant tax advantages.

1031 Exchange Benefit #1 - Tax Deferral

The popularity of IRC 1031 Exchanges rests primarily in their ability to reposition investors’ equity into different property without diluting the sales proceeds by paying tax. IRC 1031 Exchanges allow investors to defer the following taxes:

- Long-Term Capital Gains at 15% or 20%

- State Income Tax (if applicable) up to 13.3%

- Depreciation Recapture at 25%

- Net Investment Income Tax at 3.8%

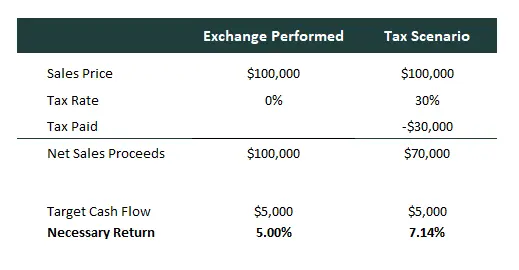

In total, the tax rate applied to a sale can be as 40% in one of the 43 states that have State Income Tax (OR, CA, HI, etc.) or 28.8% in the 7 non-Income Tax States (WA, TX, FL, etc.). For illustrative purposes, to surpass the cash flow associated with a 5% return on a property acquired through an exchange, an investor would need to find a property with a return of 7%+ when re-investing post-tax dollars. Not an easy feat, without assuming significant risk in today’s market:

1031 Exchange Benefit #2 – Repositioning Assets

If tax-deferral is not enough in and of itself, 1031 exchanges allow investors to reposition their investment into different property types, geographic markets, and ownership structures that may be more closely aligned with their investment objectives. Perhaps an investor feels that their currently owned retail property faces headwinds due to e-commerce and would prefer to be invested in multi-family apartment buildings. Perhaps an investor feels the market their currently owned property’s value is near its peak and would prefer investing a market with more potential upside or higher potential cash flow. Perhaps an investor is tired of actively managing their property and would prefer to invest in property that presents no management requirement such as Delaware Statutory Trusts or Net Lease properties. All of this is possible via an IRC 1031 Exchange due to the IRS’ broad definition of “Like-Kind”.

The IRS defines “Like-Kind” as “real property held for productive use in a trade or business or for investment.” 2 Effectively, this means all real estate other than that which is considered to be “personal use” such as a primary residence or a vacation home that does not meet the criteria for a “vacation rental”. Included within the definition of real estate is: all conventional property types such as commercial property, agricultural property, residential rental property, fractional ownership such as Tenants-In-Common and Delaware Statutory Trusts, mineral rights, water rights, and lease-hold interests with leases in excess of 30 years. Each property type has its respective strengths and risks. Understanding these opportunities, risks, and ways in which various property types can be blended together to meet owners’ objectives is a major focus of our firm. The definition of “Like-Kind” is very broad and allows investors to reposition properties so that they are in line with their financial and investment objectives.

Disadvantages of a 1031 Exchange

No investment strategy is without risks that should be recognized and considerations that must be navigated. First, real estate as an asset class is inherently illiquid and must be suitable for an investor given their financial position and objectives. One consideration that is very important to address is liquidity. Does an investor have enough liquid assets on hand to cover any large potential expenditures such as medical bills? There are ways to address this consideration, such as refinancing a property or purchasing insurance – however, available liquidity and potential liquidity needs is always worth discussing within that context of a potential exchange.

Second, exchanges can be complicated and if not executed properly, can be costly. It is very important to work with a reputable 1031 exchange company like Real Estate Transition Solutions, a competent Qualified Intermediary, knowledgeable tax counsel, as well as your financial advisor and estate planning attorney. We work together with our clients’ advisors to ensure that all parties are familiar with the rules surrounding exchanges, all relevant risks are discussed, and the transaction is executed properly.

Popularity of 1031 Exchanges With Investors

To give you an indication of the popularity of 1031 Exchanges among investors, in the 10-year period between 2004 and 2013 (the most recent period in which data is available), just over $1.3 trillion of property was exchanged (consisting of approximately 2.9 million transactions), of which $432 billion was exchanged by individuals (approximately 1.9 million transactions)1. Naturally, the popularity of exchanges coincides with the tax liabilities that would result from property sales. During a strong economy, exchanges are more common than during a recession as owners capitalize on an appreciated real estate market.

Tax-deferred exchanges can be applied in many situations depending on an owner’s investment objectives. IRC 1031 Exchanges are a very effective tool to allow owners to reposition their properties so that their real estate investments match their current financial and lifestyle objectives.

Perhaps the most common scenario in which we assist investors is restructuring their real estate portfolio to simultaneously reduce active management, increase cash flow and provide both real estate property type and geographical diversification.

If you are interested in learning more about opportunities resulting from tax-deferred exchanges and the various replacement property options available to meet both your financial and personal lifestyle objectives, you can call us at 206-686-2211 or email info@re-transition.com. We are available to discuss your specific objectives and strategize as to how your portfolio can be positioned to meet your goals.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.