1031 Exchange Rules

While 1031 Exchanges are flexible in the number of strategies that can be implemented, the 1031 exchange rules put forward by the IRS are not flexible. Failure to adhere to IRS rules can result in either a failed Exchange, in which the entire tax liability is due or a partial exchange, in which a portion of the tax liability is due.

The IRS’s motivation for allowing 1031 Exchanges is to facilitate continuous investment in real estate that is held for business or investment purposes. Exchange rules focus on two primary elements. First, there is not an infinite timeline to perform a 1031 Exchange. Second, no “economic benefit” is received by an exchanger without having paid tax. The IRS defines “economic benefit” as either receiving cash compensations (i.e. sales proceeds) or a reduction in a liability (i.e. mortgage and debt payoff).

Purpose of the 1031 Exchange Rules

While 1031 Exchanges have been in the tax code since 1921, the first 63 years of exchanges only permitted what is referred to as a “simultaneous exchange” in which property was swapped one-for-one for other property. This structure required two owners to each want the other’s property, agree to trade, and then transfer ownership directly to the other.

Following a major Federal tax court case referred to as the “Starker Case” in the 1980s, “delayed exchanges” were permitted by the IRS. Delayed exchanges are significantly more flexible than simultaneous exchanges because the exchanger can sell their investment property to any buyer, then perform an Exchange into like-kind replacement property with the resulting sales proceeds, provided they adhere to a number of specific rules.

7 Key Rules for a 1031 Exchange

- The Exchange Must be Set Up Before a Sale Occurs

This rule comes first because if a property owner does not adhere to it, there is no exchange. Before the sale of the property to be exchanged (“relinquished property”), an Exchange must be set up with a Qualified Intermediary, also known as an Exchange Facilitator or Accommodator. Setting up an Exchange with a Qualified Intermediary is a straightforward process.

Once set up, the Qualified Intermediary will notify the escrow company to transfer sales proceeds to hold on the exchanger’s behalf throughout the exchange. The IRS requires the use of a Qualified Intermediary to hold the funds so that at no point during the Exchange, the exchanger has “constructive receipt” (i.e. touching the money) of the sales proceeds.

The exchanger will also need to report their replacement property identification (see Rule #6) to their Qualified Intermediary by the identification deadline. Ultimately, the Qualified Intermediary will release the Exchange funds to the seller of the replacement property to finalize the Exchange.

- The Exchange Must be for Like-Kind Property

Both the relinquished property and replacement property must be like-kind property. The common misconception is that the property must be of the same property type. In reality, the IRS’s definition of like-kind property is much broader. Like-kind property is all property “held for business or investment purposes”. The definition includes all property types from rental homes, to agricultural land, to commercial office buildings, to raw land, to industrial property, and more. In fact, it even includes non-traditional property types such as cell towers, water rights, mineral rights, and lease-hold improvements, provided there are 30 years or more remaining on the lease.

Two property categories are not included within the definition of like-kind property. The first is any property held for personal use. Personal use typically includes primary residences as well as vacation homes. Personal use does not outright preclude a property from participating in a 1031 Exchange, however, the property cannot have the status of “personal use” at the time of either the sale or purchase, via an Exchange. The second is property acquired and held solely with the intent of reselling. For example, home builders cannot exchange the homes they build to sell, and “fix and flippers” cannot exchange the properties they improve solely to sell – provided neither have rental income during the period of ownership. In both situations, these properties are considered by the IRS to be “dealer inventory” as opposed to held for business or investment purposes.

Lastly, the IRS does not limit the number of properties that can be either sold as relinquished property or acquired as replacement property in an Exchange. Multiple relinquished properties can be sold and exchanged into a single replacement property, just as a single property can be sold and exchanged into multiple replacement properties.

- The Exchange Property Must be of Equal or Greater Value

This rule is also often misunderstood but is actually quite simple. The aggregate value of the replacement property must be equal or greater than the aggregate value of the relinquished property, less the costs associated with the sale of the property such as brokerage fees, attorney fees, title, and escrow. For example, if a property is sold for $1,000,000 with $50,000 of sales costs – the replacement property must have a value equal or greater than $950,000.

Example One

Closing Costs: <$50,000>

Net Sales Proceeds: $950,000

Notably, one of the costs that cannot be deducted when calculating the “equal or greater value” is the loan or mortgage payoff, if applicable. The second part of this rule is that an exchanger must use all net equity to acquire their replacement property. Thus, carrying our earlier example forward, if a property is sold for $1,000,000 with $50,000 of sales costs and a $200,000 loan that is paid off at closing – the replacement property must still have a value of $950,000 or greater, even though there is only $750,000 of net equity following the loan payoff.

Example Two

Closing Costs: <$50,000>

Net Sales Proceeds: $950,000

Loan Payoff: <$200,000>

Net Equity: $750,000

In Example 2, given that $750,000 of net equity is available, but the replacement property must be equal or greater to $950,000 – the replacement property requires a new loan to be obtained or outside equity can be contributed to the exchange to satisfy the replacement property value requirement. The requirement goes back to the earlier mentioned concept of “economic benefit”. Recall the IRS does not want the taxpayer to have an economic benefit resulting from the transaction without paying tax. An economic benefit is defined as either receiving cash proceeds or a reduction in a liability (e.g. debt that is not replaced in the exchange).

- The Property Owner Must Pay Capital Gains Tax on “Boot”

An exchanger must pay tax on any money or “boot” which is considered to be an “economic benefit.” The Boot includes cash proceeds withheld from an Exchange or a reduction in outstanding debt as a result of the transaction. The IRS supports 1031 Exchanges because they incentivize taxpayers to maintain continuous investment in real estate. Taking cash proceeds or acquiring less replacement property is considered “boot” and is taxable. This is not to say that exchangers are prohibited from taking cash from the Exchange or acquiring replacement property with a lower value than the replacement property, only that any amount of “boot” is taxable.

Furthermore, it is important to note that the tax rate applied to any “boot” will first be the most expensive Federal tax rate – depreciation recapture tax at a flat rate of 25%. If the “boot” resulting from the Exchange exceeds the amount of depreciation taken over the period of time the property was owned, then the Federal and state level (if applicable) capital gains tax will be applied. Capital gains tax can range from 15% – 20% at the Federal level and 0% – 13.3% at the state level. Point being, the IRS will treat all boot as the most “expensive” dollars from a tax standpoint.

- The Taxpayer that Sold and Acquired the Exchange Property Must be the Same

The entity on the title at the time of sale (closing), must be the entity that performs the exchange and thus is on the title of the replacement property immediately following the acquisition. If the relinquished property has an LLC on the title at the time of sale, the same LLC must be on the title of the replacement property. This is not to say that the legal entity that has historically owned a property cannot be modified or changed before the sale closes.

Regularly, properties that are owned in co-ownership arrangements, such as multi-member LLCs or Partnerships, convert their ownership to a Tenant-In-Common (TIC) to stage for an exchange. This often occurs immediately before a sale to allow the co-owners the flexibility to either exchange into their own replacement property or pay tax as a result of the sale. Additionally, ownership can be converted following an Exchange as well.

Preserving the legal entity on the title at the time of sale is rarely an issue for exchangers. If an exchanger is in a co-ownership arrangement with owners seeking to go different directions, we recommend reaching out to us so that we can assist in understanding options available to navigate a potential restructure.

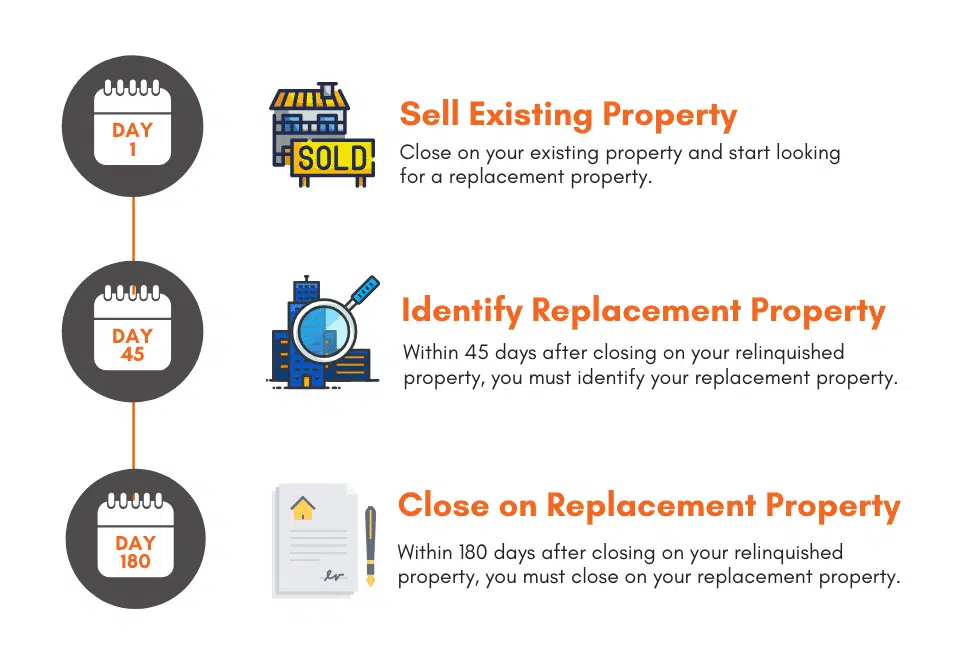

- The Property Owner has 45 Days to Identify Replacement Properties

The 1031 Exchange Timeline is very straight forward with three key dates to be aware of: (1) Day 1 – The day the relinquished property is sold, (2) Day 45 – The day the property identification is due, and (3) Day 180 – The day the exchange must be completed by.

Make no mistake, the first 45 days of an Exchange will go by much faster than most anticipate. With the exception of Federally declared disasters that directly impact either the exchanger, Qualified Intermediary, or exchanger’s CPA, there are no extensions granted for any of the above dates. It does not matter if day 45 falls on a Wednesday, Sunday, or Christmas – the deadline is 45 calendar days to submit the replacement property identification to the Qualified Intermediary.

The replacement property identification must be both clear and specific. Typically, each identification must include the address of the property and the anticipated purchase price of the property. If an exchanger plans to purchase less than 100% of a property (i.e. DST property or TIC property), they should also include the projected percentage of ownership.

There are three available methods for identifying replacement property, however, only one method can be selected and used by an exchanger. With the exception of the third method, there is no requirement to purchase a certain number of the properties identified:

- Three Property Rule: An exchanger may identify up to three replacement properties, regardless of the value of the properties.

- 200% Rule: An exchanger may identify any number of replacement properties, as long as the aggregate value of the properties identified does not exceed 200% of the value of the relinquished property.

- 95% Rule: An exchanger may identify any number of properties with any aggregate value, as long as they close on 95% of the aggregate value of the replacement properties.

Once the identification is submitted, changes can be made up until the 45th day. Following the 45th day, no new replacement properties can be included or acquired with Exchange proceeds. The short timeline is one of the many reasons why working with a quality team is of the utmost importance.

- The Property Owner has 180 Days to Complete the Exchange

Following the identification of the replacement property, the exchanger has an additional 135 days to finalize the acquisition of their replacement property by the 180-day deadline. Note – there is no requirement that an exchanger must wait until after the 45-day identification period to acquire replacement property – this can occur anytime following the sale of their relinquished property. 180 days is, however, the maximum timeline.

One important item to note is that should an exchange occur toward the end of the calendar year and should the 180-day window end in the following year – the exchanger must not file their taxes for the year in which the property sold until the exchange is complete. We cannot stress this enough. Taxes cannot be amended to take into account 1031 Exchanges that occurred but were unrecorded in a previous year. Thus, filing taxes before the exchange is complete would serve to invalidate the Exchange.

Speak with a Licensed 1031 Exchange Advisor

If you’re an investment real estate owner with questions about estate planning, DSTs, or executing a 1031 Exchange, contact Real Estate Transition Solutions to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors. Our free consultations can be done over the phone, via web meeting, or in person at our offices located in Seattle, WA and throughout the West Coast. To schedule your free consultation, call 888-409-5097, email info@re-transition.com, or book directly with an Advisor online.

Download FREE Guide

1031 Exchange Basics

Learn how Exchanges work, the benefits vs. risks, IRS rules & timing, property types, and exchange options available