How to Find 1031 Exchange Properties

and Replacement Options

- By Austin Bowlin, CPA

Table of Contents

Finding the Right 1031 Replacement Property

In a 1031 Exchange, while the relinquished property often takes center stage due to its tax deferral benefits, the ultimate success of the exchange hinges on the thoughtful selection of the replacement property.

Choosing the right replacement property involves aligning it with your financial and lifestyle objectives. These may include your preferred level of property management involvement, income and cash flow needs, liquidity requirements, portfolio diversification, risk tolerance, and estate planning goals. To achieve these outcomes, it’s essential to carefully evaluate factors such as location, asset type, and ownership structure during your replacement property search.

What is a 1031 Exchange?

Selling Your Relinquished Property

In the context of a 1031 Exchange, the relinquished property is the real estate asset that an investor decides to sell. This property must have been held for productive use in a trade, business, or for investment. It’s important to document and prove the intent to hold for investment, as personal residences do not qualify for a 1031 Exchange. The key benefit of selling this property under a 1031 Exchange is the ability to defer capital gains taxes, which can be particularly significant for properties that have appreciated substantially over time.

Reinvesting Proceeds into Replacement Property

The replacement property is the new asset purchased with the proceeds from the relinquished property. This transaction must align with specific IRS regulations to qualify as a valid 1031 Exchange. The benefits of acquiring a replacement property include opportunities for diversification, enhanced income potential, and strategic realignment with the investor’s current financial goals. Delaware Statutory Trusts (DSTs) are eligible as replacement properties for 1031 Exchanges.

Requirements for 1031 Replacement Properties

Navigating the intricacies of a 1031 Exchange involves understanding specific IRS requirements for replacement properties. These guidelines ensure that properties exchanged align with investment purposes and that the exchange complies with tax deferral objectives, avoiding any unexpected tax liabilities.

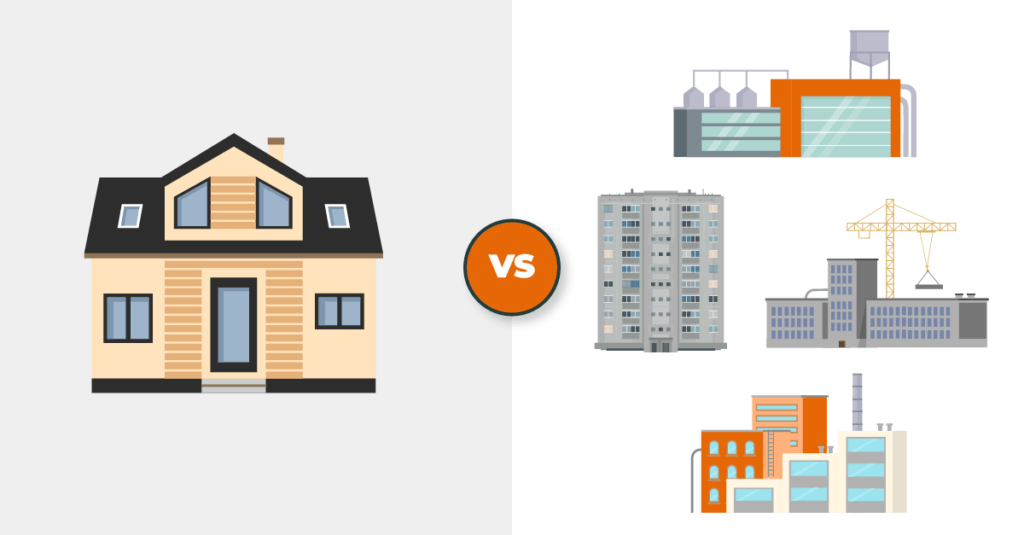

The Like-Kind Rule

The IRS stipulates that the replacement property must be “like-kind” to the relinquished property. A common misconception about this rule is that the relinquished and replacement property must be of the same type, but this is not true. The “like-kind” rule is broad, and generally means both properties must be held for investment purposes. For example, a retail lease property can be exchanged for an industrial property and a multifamily home held for investment purposes can be exchanged for a medical office building.

The Productive Use Rule

The Productive Use Rule mandates that both properties involved in the exchange must be used for business, trade, or investment purposes. This rule is in place to ensure that the 1031 Exchange is not utilized for personal real estate transactions. The intent of use, both before and after the exchange, is scrutinized in this rule. For example, an investor cannot use a 1031 Exchange to swap a rental property for a personal vacation home unless the vacation home is converted into a rental property. The specific amount of time needed to rent a property before conducting an exchange depends on the guidance of your tax advisor.

Property Values and Boot

The value of the replacement property must be equal to or greater than that of the relinquished property to fully defer capital gains taxes. Any additional cash or debt reduction received from the exchange, known as “boot,” is taxable.

Comparing Ownership Structures for 1031 Properties

Choosing the appropriate ownership structure is an important aspect of selecting a replacement property for your 1031 Exchange. From the autonomy of fee simple ownership to the unique benefits of Delaware Statutory Trusts (DSTs), understanding these structures helps ensure that your investment aligns with your management preferences, risk tolerance, and long-term objectives.

Ownership Type Comparisons

| DST Properties | Fee Simple Properties | |

|---|---|---|

| Ownership Structure | Investors own a beneficial interest in the trust. | Direct ownership of the property. |

| Management | Passive; managed by DST Sponsor, no investor management involvement. | Active; owner has full control and responsibility for management. |

| Financing | Non-recourse financing; debt is held by the DST, not the individual investors. | Owner can choose the type of financing; personal liability is typically involved. |

| Number of Investors | Can accommodate a large number of investors (up to 499). | No limit, but usually owned by an individual or a single entity. |

| Minimum Investment | Generally $100,000; lower minimum investment compared to Fee Simple. | Varies widely; can be high depending on the property value. |

| Liquidity | Limited liquidity, requires holding for a set term (typically 5-10 years) before exiting the investment. | More liquid in some situations since you can sell, lease, or leverage the property on the open market. |

| Decision Making | DST Sponsor is in charge of decision making. | Full control and responsibility for property decisions. |

| Diversification | Potential for greater diversification into different markets. A single DST can hold many properties and a single 1031 Exchange can result in multiple DSTs. | Highly concentrated to the property and location. Multiple properties need to be individually purchased to diversify portfolio. |

| Risk | Lower individual risk due to non-recourse debt, professional management, diversification potential, and institutional-grade property. | Potential for higher risk due to direct control of the property and concentration of investment. |

Fee-Simple Properties

Fee-simple properties are the most comprehensive and unrestricted form of property ownership. It grants the owner full control over the property, including the rights to sell, lease, or alter the property as they see fit. This ownership type is particularly appealing for investors who prefer direct and complete control over their investments.

Fee-simple ownership offers the flexibility to make significant decisions about the property, such as undertaking major renovations, redeveloping the property, or selling it when the market is favorable. However, with this level of control comes the responsibility of managing the property, including handling tenants, maintenance, and any legal or regulatory issues that arise. Fee simple properties can also include Triple Net Leases (NNN).

Delaware Statutory Trust (DST) Properties

Delaware Statutory Trust (DST) properties are becoming an increasingly popular vehicle for 1031 Exchanges. In a DST, investors own a fractional interest in a trust that holds large-scale, institutional-grade real estate. One of the key advantages of DSTs is the opportunity for diversification, as these trusts can own a variety of property types across different geographic locations. Additionally, DSTs are managed by professional managers, removing the day-to-day management responsibilities from the individual investors.

DSTs come with certain limitations, such as restrictions on raising additional funds or making significant changes to the properties. Investors in DSTs also have limited control over the investment, as decisions are made by the DST Sponsor. DSTs The liquidity aspect of a DST can be enhanced through a 721 Exchange, offering a pathway to convert DST interests into shares of a Real Estate Investment Trust (REIT).

DSTs emerged as an investment vehicle in part due to the limitations and complexities associated with Tenants in Common (TIC) structures, especially in the context of 1031 Exchanges. TIC arrangements typically involve a much higher investment minimum, more active management requirements, plus additional challenges.

Comparing 1031 Exchange Property Types

When undertaking a 1031 Exchange, choosing the right type of replacement property is essential for aligning your investment strategy with your goals. From the steady income potential of multifamily properties to the growing appeal of industrial spaces in the e-commerce era, each category offers distinct advantages and considerations.

Key differences to consider when evaluating replacement property types include income stability, vacancy rates, capital appreciation potential, management intensity, and tenant turnover frequency. Additionally, factors such as market demand trends, maintenance costs, and susceptibility to economic cycles play crucial roles in determining investment viability.

Industrial Properties

Industrial properties, including warehouses, distribution centers, and manufacturing facilities, have gained popularity as replacement properties, especially within DST ownership structures. The growth of e-commerce and the need for large distribution centers has helped fuel the growth of this sector.

Multifamily Properties

Multifamily properties, such as apartment complexes and condominiums, are popular as 1031 Exchange replacement properties for their potential to generate steady rental income. These properties offer the potential for value-add strategies through renovations and upgrades, which can increase rental income and property value.

Self-Storage Properties

Self-storage facilities typically require less day-to-day management and have shown resilience in economic downturns. The demand for storage units tends to remain stable, as people and businesses always need storage space, regardless of the economic climate. These facilities can provide a steady income stream with relatively low overhead costs.

Retail Net Lease Properties

Retail Net Lease properties, particularly those with high-quality tenants and long-term leases, offer investors the potential for a hands-off approach with a stable income. These can include grocery stores, pharmacies, and specialty shops.

Senior Housing Properties

Senior housing properties include assisted living, memory care, and active senior living communities. This sector is growing in demand due demographic trends, such as an aging population.

Single Family Rental Properties

Investing in single family rental homes is a traditional real estate investment strategy that can provide a steady income and benefits from property appreciation.

Office Properties

Office buildings can attract long-term leases with corporate tenants, providing stable and predictable income. The value of office buildings is closely tied to the local business environment, making location a crucial factor.

How to Find the Right 1031 Replacement Properties

Selecting the ideal replacement property in a 1031 Exchange is a critical decision that requires careful consideration of both financial and lifestyle objectives. This process is not just about deferring capital gains taxes; it’s also about finding a property that aligns with your overall investment strategy and personal goals.

From assessing property management needs to understanding the importance of liquidity and diversification, this section guides you through the key factors to consider when identifying suitable replacement properties. By thoroughly evaluating these elements, investors can make informed decisions that not only meet immediate financial needs but also contribute to long-term estate planning and risk management.

Setting Financial and Lifestyle Objectives

Identifying clear financial and lifestyle objectives is an essential step in the 1031 Exchange process. These goals should guide your selection of a replacement property and include:

Consider your willingness and ability to manage the property. Properties requiring significant management may not be suitable for investors looking for a hands-off approach.

Evaluate the income potential of the property and its alignment with your cash flow requirements, especially if the investment income is a significant part of your financial plan.

The ease of converting the property into cash is an important consideration, particularly for investors who may need quick access to funds.

Look for properties that diversify your portfolio, either by geography, property type, or tenant mix, to mitigate risk.

Assess the level of risk associated with the property, considering factors like market volatility, tenant stability, and economic cycles.

Factor in how the property aligns with your long-term estate planning goals, including the ease of transferring ownership to beneficiaries and the potential tax advantages or liabilities for your estate.

Aligning Personal Objectives with Replacement Property Features

After setting your financial and lifestyle objectives, you will want to align them with the specific features of potential replacement properties:

Selecting the Right Ownership Structure

Decide on the type of ownership that fits your needs. For those seeking hands-off management, a Delaware Statutory Trust (DST) is a good option. DSTs are managed by professionals, offering fractional ownership in larger, institutional-grade real estate, making them suitable for investors who prefer not to deal with day-to-day management.

If you desire more active involvement and control, Fee Simple ownership is more appropriate. This option allows for direct management of the property, offering the flexibility to make significant decisions, such as renovations or sales.

Selecting the Right Property Type

Select a property type that aligns with your income goals and management preferences. Investors looking for steady, passive income might prefer Net Lease Properties, where tenants handle most of the operational expenses, providing a relatively worry-free investment.

Those interested in more active engagement and potential for value-add strategies might lean towards Multifamily Properties, offering opportunities for enhancements to boost value and income.

The Role of Due Diligence

Understanding the relationship between your investment goals and the various ownership structures and property types is just the beginning of the journey in a 1031 Exchange. The next step is due diligence, a process that delves deeper into the specifics of potential properties to ensure they align with your objectives.

When conducting due diligence for a 1031 Exchange, the following factors must be considered to align replacement properties with investor objectives:

Evaluate economic conditions, employment trends, and regulatory environments in potential property locations to assess their impact on property value and income potential.

Investigate the physical condition of the property, its potential for appreciation, and ongoing maintenance requirements, including an assessment of lease terms and environmental factors.

For rental properties, examine the tenant mix, lease terms, and creditworthiness to gauge the stability and predictability of income.

Study the demographics, growth patterns, and future development plans of the area surrounding the property to understand its potential appeal and value.

In case of syndicates or DSTs, scrutinize the track record, financial health, and operational history of the sponsor or syndicator, including their investment strategy and communication transparency.

Analyze the business plan for the property, focusing on financial projections, property management strategies, and exit plans.

Conduct a thorough market and submarket analysis, reviewing historical performance, construction forecasts, vacancy rates, rent growth scenarios, and comparable property transactions.

Utilize reports from independent third parties to verify investment structures and theses, adding an objective layer to the evaluation.

Real Estate Transition Solutions is known for having one of the most thorough and effective due diligence teams in the DST industry. Schedule a free consultation with one of our licensed 1031 Exchange Advisors to learn more about our hand-picked DST offerings.

Why Exchange into New Markets?

Investment property owners often stick to markets and property types they know well, but exploring new markets can offer unique benefits and opportunities. Here’s some of the potential advantages of venturing into new markets:

Investment property owners often stick to markets and property types they know well, but exploring new markets can offer unique benefits and opportunities. Here’s some of the potential advantages of venturing into new markets:

- Tax Incentives: Different regions may offer varying tax advantages, such as lower property taxes or specific incentives for property development and investment. These incentives can significantly enhance the profitability and attractiveness of investments in certain areas.

- Growth Potential: Emerging or revitalizing markets often present strong growth potential. Investing in these areas can result in higher capital appreciation as the region develops, especially if you enter the market early in its growth phase.

- Employment Prospects: Markets with growing or stable employment opportunities tend to attract a steady influx of tenants. Properties in these areas can benefit from higher demand, leading to lower vacancy rates and potentially higher rental incomes.

- Landlord Regulations: Different areas have different regulations impacting landlords. Some markets are more landlord-friendly, offering fewer restrictions on rent increases and tenant evictions, which can make property management more straightforward and potentially more profitable.

- Property Diversity: Diversifying your investment portfolio across various markets can reduce risk. Different markets respond differently to economic cycles, so having properties in multiple locations can stabilize your income flow and investment value over time.

- Tenant Dynamics: Different markets attract different types of tenants, each with unique characteristics and stability. For instance, a market close to a major university may consistently attract student tenants, while another near a tech hub might attract young professionals, impacting both tenant turnover and rental pricing strategies.

Exploring new markets through a 1031 Exchange can be a strategic move for investors aiming to adapt to changing real estate landscapes. Up-and-coming locations and emerging property types may offer promising opportunities that align with future market trends. These new markets often present potential for higher growth, especially in areas experiencing economic revitalization, demographic shifts, or technological advancements.

By diversifying into different geographies and property types, investors can tap into new income streams and leverage the growth potential of these burgeoning markets. This proactive approach not only broadens the investment horizon but also positions the portfolio to capitalize on areas poised for success in the future.

Key Factors to Consider When Evaluating New Markets

Assessing new real estate markets requires a strategic blend of personal goals, economic trends, and localized factors. Understanding these factors helps to ensure that your objectives are in sync with the target market’s unique attributes:

Personal Factors

- Investment Objectives

- Financial Situation

- Property Management Preferences

- Expertise & Knowledge

- 1031 Exchange Timeline

Economic Factors

- Market Conditions

- Interest Rates

- Inflation Data

- Tax Implications

- Capital Improvements

Local Factors

- Location

- Local Real Estate Trends

- Landlord-Tenant Laws

- Crime and Safety

- Employment and Migration

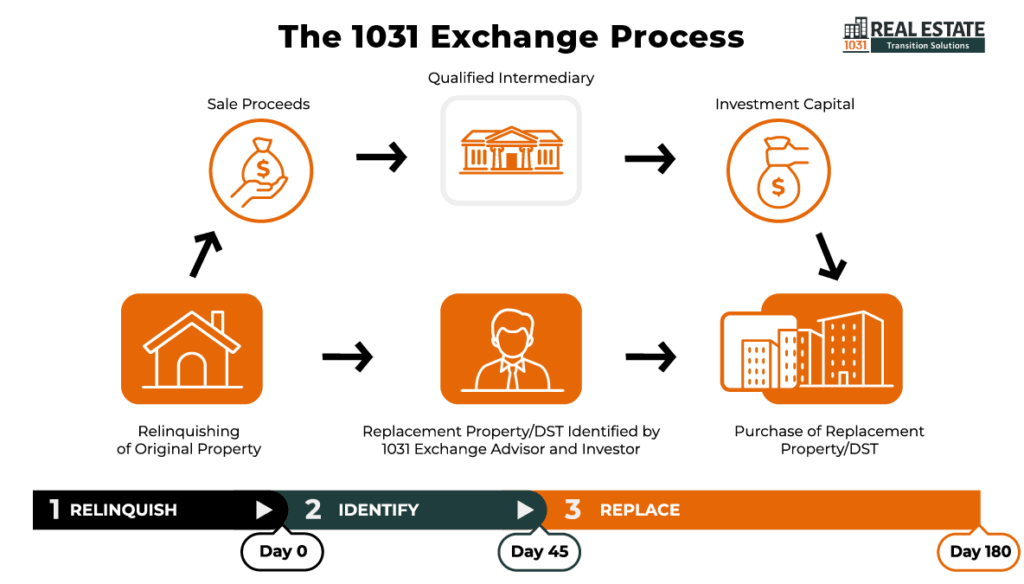

Rules and Timelines for 1031 Exchanges

Compliance with Internal Revenue Service (IRS) rules is fundamental to executing a successful 1031 Exchange. These rules define eligible properties, outline the exchange timeline, and dictate the process for reinvesting the proceeds from the sold property. Non-compliance can lead to the disqualification of the exchange, resulting in immediate tax liabilities. Key rules include:

- Property Qualification: Both the relinquished and replacement properties must be used for business or investment purposes and must be ‘like-kind’.

- Timeline Adherence: Strict adherence to the IRS-defined timeline for identifying and closing on the replacement property is mandatory.

- Qualified Intermediary Requirement: The use of a qualified intermediary to facilitate the exchange and hold the proceeds is required to ensure impartiality and compliance.

8 Steps in the 1031 Exchange Timeline

There are 8 key steps in the 1031 Exchange process which you can review in detail on our 1031 Exchange Process page. Here is a quick summary of the 8 steps:

- Determine If a 1031 Exchange is Right for You

- Develop a Tax-Deferred Transition Strategy with Your 1031 Exchange Advisor

- Inform Your Tax Advisor, Estate Planning Attorney, and Financial Advisor About Your 1031 Exchange

- Enter into a Contract to Sell Your Existing Investment Property

- Select a Qualified Intermediary and Open an Exchange

- Identify Your 1031 Exchange Replacement Property (45-Day Rule)

- Close on Your 1031 Exchange Replacement Property (180-Day Rule)

- After the Exchange is Complete, Notify Your Tax Advisor

Frequently Asked Questions About 1031 Exchanges

Investment properties that align with the investor’s financial goals, risk tolerance, and market conditions are ideal replacement properties for 1031 Exchanges. Diversification, potential for income, and growth should be considered when selecting properties.

Generally, a property acquired through a 1031 Exchange must be held for investment purposes. Living in the property may disqualify it from being considered a valid exchange.

The Delayed Exchange is the most common type, where the investor sells the relinquished property first and then acquires the replacement property within the set timelines.

Consulting with a 1031 Exchange Advisor

For personalized advice and a comprehensive approach to 1031 Exchanges, consider scheduling a consultation with a licensed 1031 Exchange Advisor at Real Estate Transition Solutions. A licensed 1031 Exchange Advisor can provide personalized advice, helping you navigate the complexities of 1031 Exchanges and alternative real estate investment strategies. They can assist in evaluating properties, conducting due diligence, and ensuring compliance with IRS rules and timelines.

Whether you’re considering a 1031 Exchange or exploring alternative real estate investment strategies, it’s crucial to weigh your options carefully, considering your financial goals, risk tolerance, and investment horizon. With the right approach and expert guidance, you can make informed decisions that align with your investment objectives and enhance your real estate portfolio’s potential.

If you’re a real estate investor with questions about estate planning, DSTs, or executing a 1031 Exchange, contact Real Estate Transition Solutions to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors. Our free consultations can be done over the phone, via web meeting, or in person at our offices located in Seattle, WA and throughout the West Coast. To schedule your free consultation, call 888-409-5097, email info@re-transition.com, or book directly with an Advisor online.

Austin Bowlin, CPA is a Partner at Real Estate Transition Solutions (RETS), a national real estate investment advisory firm specializing in 1031 Exchange strategies and Delaware Statutory Trust investments. As Chief Exchange Strategist, Austin leads the firm’s team of licensed 1031 Exchange advisors and analysts. His work focuses on tax analysis, developing tax-deferral strategies, legal entity re-structuring, co-ownership arrangements, 1031 replacement property options, and Delaware Statutory Trust investments.