Welcome RHA Oregon Members

Selling Your Oregon Rental Property?

Avoid Paying Gains Tax with a 1031 Exchange.

Oregon property owners can pay up to 37.7% in taxes from the sale of investment property. By performing an IRC 1031 Exchange, you can defer, reduce, and even eliminate paying these taxes.

If you have plans to sell your highly appreciated investment property and would like to learn more about tax-deferred 1031 Exchanges, you’re at the right place. We make it easy to learn about 1031 Exchanges and offer complimentary consultations to RHA Oregon members.

If you have any questions or would like to speak with one of our licensed 1031 Exchange Advisors regarding your options, simply give us a call at 503-832-6463 or send us an email at info@re-transition.com.

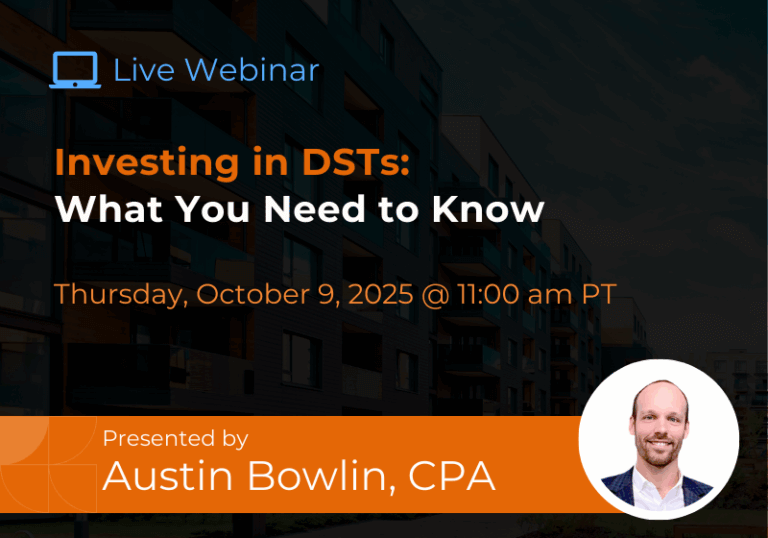

Upcoming Webinars

10 Trends Impacting 1031 Exchanges in 2021

Unexpected events and economic changes impact real estate investors every year, but 2020 stands out like no other. The global pandemic abruptly and dramatically disrupted multifamily housing, office, retail, and hospitality sectors of the industry. Inevitably, savvy investors shifted focus and strategy as long-term tenant trends and investment opportunities started to emerge.

Location and asset class are always key factors in any real estate transaction, and they will play an even bigger role in 2021. Demand for industrial distribution centers and office parks in the suburbs is accelerating. Relocations to mid-size cities will spike in 2021.

Before selecting replacement property consider these 10 trends impacting your 1031 replacement property selection in the new year. Speak with one of our licensed 1031 Exchange Advisors to learn how these trends may impact you.

About Real Estate Transition Solutions

Real Estate Transition Solutions is an advisory firm specializing in tax-deferred 1031 Exchange strategies, Delaware Statutory Trust investments, and fractional replacement property options. For over 20 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well planned, tax-efficient transition strategies carefully designed to meet their financial & lifestyle objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire Exchange process and help you select and acquire 1031 replacement properties best suited to meet your goals.

-

Real Estate Transition Solutions

Portland Meeting Office

650 NE Holladay Street, Ste. 1600

Portland, OR 97232