DST Offering Detail

JLLX Diversified III DST

DST Offering Highlights

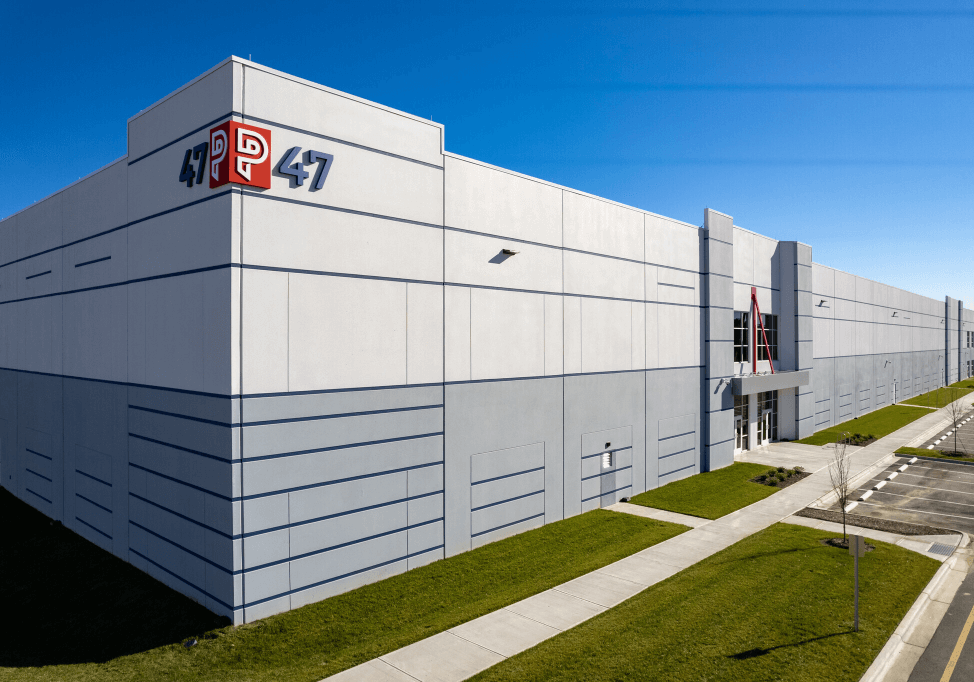

JLLX Diversified III DST is comprised of two properties, a life science industrial property in North Carolina and a medical office property in New Jersey. In total, the two properties combine to provide approximately 288,000 square feet of life science and medical office space, leased to two tenants with a weighted average remaining lease term of 7.01 years. The 47 National Way property is part of the Patriot Park building campus located in Durham, North Carolina – 15 minutes southeast of downtown Durham and 20 minutes northwest of downtown Raleigh. Built in 2020, the life sciences property provides over 187,000 square feet on 32.31 acres with 189 surface parking spaces. The 140 Park Ave Property is a four-story medical office building located in Florham Park, New Jersey – approximately 30 minutes west of downtown New York City. Built in 2015, the property provides over 100,000 rental square feet on 6.64 acres with 538 surface parking spaces. 140 Park Ave is 100% leased to the sole tenant, Summit Health Management, LLC, a physician-driven network that allows for easy access to health care for clients.

| Property Status: | Closed Offering |

|---|---|

| Property Type: | Industrial |

| Property State: | Multiple States |

| Property City: | Multiple Cities |

| Properties: | 2 |

| Units: | N/A |

| Offering Size: | $95,916,712 |

| Equity Offering: | $95,916,712 |

| Loan-to-Value: | 0% |

| Loan Terms: | No Debt |

| Cash Flow: | Call to Confirm |

About Jones Lang LaSalle (JLL)

Jones Lang LaSalle (JLL) Investment Management, one of the world’s largest managers of institutional capital invested in real estate and real estate-related assets, serves as manager of the sponsor’s Delaware Statutory Trust (DST) investments. Following ownership of the DST, JLL offers a unique disposition strategy of performing a 721 UPREIT into their billion-dollar REIT – the JLL Income Property Trust.

Benefits of a Delaware Statutory Trust

Delaware Statutory Trusts are a popular 1031 Exchange replacement property option that allows for fractional ownership of high-quality institutional properties acquired by and managed by large real estate firms, referred to as DST sponsors. DSTs provide a unique and flexible solution to investment property owners who want to defer tax and continue to own investment property without the management requirements of directly owned property. Below are some of the benefits of investing in DST real estate.

- Tax Savings: DSTs allow for the deferral of federal capital gains tax, state capital gains tax, net investment income tax, and depreciation recapture tax. The tax savings can be significant, especially in states where the potential tax liability can be as high as 42%.

- Monthly Income Potential: DSTs are structured with an emphasis on cash flow for investors and typically include high-quality institutional property.

- Eliminate Active Property Management: Ownership of a DST is entirely management free.

- Eliminate Tax for Estate Beneficiaries: DSTs allow for a “step-up in basis” upon the passing of an owner (elimination of Capital Gains, Depreciation Recapture, and Net Investment Income Tax).

- Low-Cost Non-Recourse Debt Matching: Most investors have debt that must be matched in their exchange, therefor many DSTs are structured with debt in place.

- Low Risk of a Failed 1031 Exchange: Extensive DST property due diligence is prepared in advance and DST closings can occur quickly – in a matter of days.

DST Risks

DSTs offer many benefits however they are not suitable for everyone and come with risks. Therefore, DSTs are only available to accredited investors. Before deciding to invest in DST real estate, carefully consider the following considerations: Lack of liquidity, timing of exit, lack of control, and interest rates can affect financing, leasing, and appreciation. Additionally, loan modifications may not always be possible, cash flow is not guaranteed, and projected appreciation may not occur. There are also management costs and fees associated with owning DSTs which are disclosed in the prospectus. While not a precisely defined term, a high grade, institutional-grade, or institutional-quality property generally refers to a property of sufficient size and stature to merit attention from large national or international investors.