Utilizing Delaware Statutory Trusts in Estate Planning

Investment property owners have many considerations when estate planning.

As time passes and new chapters of life begin, investment real estate owner’s financial and lifestyle objectives change. We often work with owners who no longer want to spend time managing tenants, addressing new regulatory issues and paying for large capital projects such as new roofs or updating appliances. Instead they want to spend time with their children and grandchildren, travel, and pursue hobbies. We often hear these owners say, “I want to simplify my life”, which is a very worthy goal.

Around the time of life in which owners begin to place a higher value on free time, they should also begin addressing estate planning. Estate planning brings with it many considerations. However, simply choosing to sell highly appreciated investment real estate because it seems like the easiest option can expose owners to a large capital gains tax liability and eliminates the opportunity to use real estate to reduce one’s future estate tax liability. If owners of investment real estate find themselves in this situation, they should consider the approach outlined below.

Delaware Statutory Trusts can be an effective estate planning tool for many property owners.

Highly appreciated property can be sold and 1031 exchanged into a Delaware Statutory Trust (DST). DSTs are funds of institutional real estate managed by national real estate sponsors and are considered “like-kind” property for 1031 exchange purposes. Generally, DSTs have the following objectives:

- Owning strong, stable institutional property such as large multi-family buildings, self-storage, medical-office, etc.

- Third party management, eliminating the headaches of active management by investment property owners

- Producing predictable cash flow

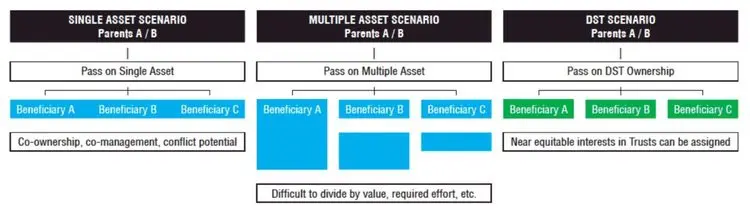

What’s more, DSTs are an effective estate planning tool. Because they have relatively low minimum investment requirements of $100k, and 1031 exchange laws allow for multiple properties to be exchanged into, the proceeds from the sale of a single real estate asset can be exchanged into multiple DSTs of equal amounts. Effectively this allows for an even distribution of real estate among the estate’s beneficiaries by specifically identifying DSTs for each beneficiary. Consider the following comparison:

Here we see that DSTs can allow for a far more even allocation of assets among beneficiaries. Furthermore, the beneficiaries do not need to actively manage the property and are free to pursue their careers and busy lives while still reaping the benefits of ownership such as potential for predictable cash flow and the opportunity to continue to tax defer through exchanges.

Delaware Statutory Trusts is considered ownership of a “minority share of a non-public entity” meaning they are eligible for a “discount for lack of marketability” (DLOM). This discount can reduce the value of the real estate owned by as much as 35% from fair market value when calculating the total assets within the estate.

Furthermore, since ownership of beneficial interests in DSTs is tangible real property, a surviving spouse would still receive a complete step-up in tax basis in a community property state such as Washington.

There are many ways to approach estate planning considerations and the right approach is dictated by your individual objectives, assets and family dynamics. Delaware Statutory Trusts tend to be a versatile form of ownership that can potentially satisfy many objectives of owners who are in the third and fourth quarters of life, both during their own lifetime and in the transference of assets to their beneficiaries.

If you are interested in learning more about DST ownership as a tax-deferral strategy, I encourage you to download our free guide, “Investing in Delaware Statutory Trusts”. To speak to one of our 1031 Exchange professionals or to schedule a complimentary consultation, call us at 206-686-2211 or email DSTconsult@re-transition.com

Austin Bowlin, CPA – Partner at Real Estate Transition Solutions, provides exit strategy analysis, execution, income and equity replacement options for investment property owners. If you have questions relating to your investment property ownership, please email info@re-transition.com or call (206) 686-2211.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options