Selling Your Investment Property?

How to Calculate Tax Liability

Even in the most robust seller’s market, there is one thing that gives an investment property owner pause: capital gains taxes. A California investment property owner, for example, can pay as much as 42.1% in taxes related to the sale of their property. The high tax liability in several states is driving many investors to explore tax-deferral strategies. This property owner should consider a 1031 Exchange in California.

Understanding Tax Liability

Capital Gains Tax + Depreciation Recapture Tax = Total Tax Liability

As a licensed 1031 Exchange Advisor, one of the first things we do when working with a client is to help them understand their tax liability. A tax liability from the sale of investment real estate is not just about federal capital gains tax – it is the total aggregate amount of tax owed when an investment property is sold. Not only are you responsible for Federal Capital Gains Tax (15% – 20%), but you may also have to pay State Capital Gains Tax (0-13.3%), Depreciation Recapture Tax (25%), and Net Investment Income Tax (3.8%).

Five Steps to Calculate Your Tax Liability

Federal & state tax authorities calculate the amount you owe based on the taxable gain, not the gross proceeds from the sale of the property. To estimate the total tax liability after the sale of an asset, follow these five steps:

Step 1: Estimate the Net Sales Proceeds

Start by determining the fair market value of the investment property or the list price if you brought the property to market. There are several ways to calculate the sales price, but the most popular are the income method and the comparable sale method.

- With the income method, divide the current or estimated net operating income (“NOI”) by the target capitalization rate (“cap rate”).

- With the comparable sales method, an investor determines a value based on recent sales of local comparable properties, both in terms of size and quality.

Smaller properties and single-family rentals typically rely on the comparable sales method, while larger properties rely on net operating income to determine value. Most investors work with an experienced broker to set a supportable sales price.

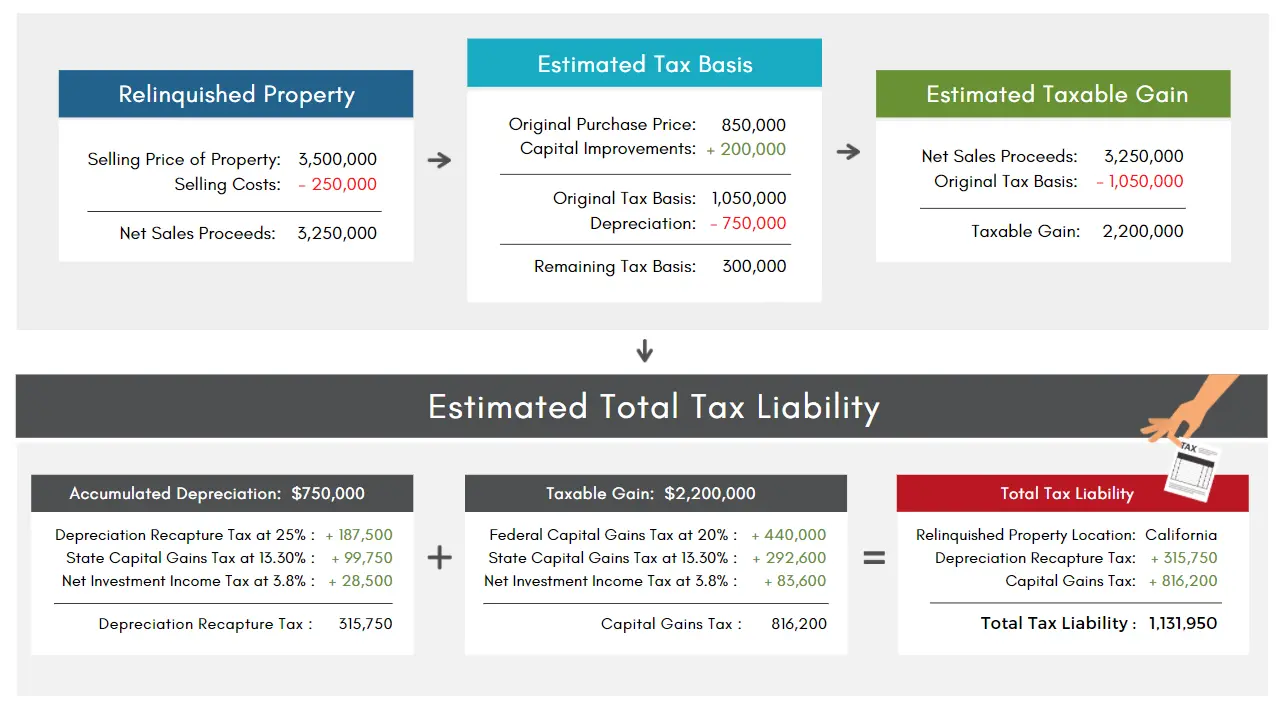

For example, let’s assume a comparison of similar local properties indicates a property may sell for $3,500,000 with $250,000 in deductible selling costs such as brokerage costs, title, escrow, and excise tax (if applicable). In this scenario, the net sales proceeds would be $3,250,000. Importantly, the net sales proceeds do not consider any loan balances paid off at closing.

Step 2: Estimate the Tax Basis

Tax basis, also known as remaining basis, is the total capital that an owner has invested and capitalized in the asset, including the purchase price, closing costs, and capitalized improvements less the accumulated depreciation. For example, if you purchased the property for $850,000, invested $200,000 in capital improvements and have $750,000 in depreciation, your remaining basis is $300,000. There are some limitations to the items that you can include in the tax basis. Mortgage insurance premiums and routine maintenance costs are examples of items that are not included. A tax advisor can help to determine your property’s current remaining basis, which can be adjusted based on capital improvements and tax deductions.

- Increasing the Tax Basis: Property owners will increase their tax basis anytime they invest money into the property with capitalized improvements—such as a new kitchen, roof, or even an addition, as well as financing expenses. Expenses paid to operate the property, like legal fees, management expense and small repairs are not capitalized and instead treated as operating expenses. Capitalized improvements increase your investment in the property and are deducted from the net sales proceeds at the time of the sale to arrive at the property’s gain. While some of these costs are intrinsic to real estate investment, like escrow fees, others are flexible. A new roof, an upgrade to the kitchen, or adding a pool are capital improvements that have a wide range of costs, giving the owner some flexibility in the amount they can increase the tax basis of the asset versus deduct in the current year as an operating expense.

- Decreasing the Tax Basis: Owners of investment real estate that include a building or structure must also decrease the property’s tax basis, ultimately increasing the figure used to calculate the second form of gain referred to as “depreciation recapture”. The most common way to decrease the tax basis is through an annual depreciation deduction. The deduction is subtracted from the tax basis on an annual basis to be treated as a tax expense offsetting income which is then recaptured at the time of sale. While it might seem unexpected to decrease your tax basis and eventually increase your tax costs, the depreciation deduction reduces an investor’s annual taxable income and thus income tax due during the years of ownership. Note that annual depreciation is not optional. Investors will be charged for depreciation recapture on the aggregate amount of available depreciation throughout the period of ownership regardless of whether they recorded depreciation expense. Easements, some insurance reimbursements, and other tax deductions, like personal property deductions, can also decrease your tax basis.

Step 3: Calculate Taxable Gain

The taxable gain is the realized return or profit from the sale of an asset, or, in other words, it is the net sales proceeds less the original tax basis, pre-depreciation. Tax authorities like the IRS and Franchise Tax Board use the taxable gain figure to determine the capital gains tax. To calculate the taxable gain, subtract the original tax basis from the net sale proceeds. Using the earlier example, if your original tax basis is $1,050,000 and the net proceeds from the sale of the property is $3,250,000, your taxable gain is $2,200,000. The second part of the tax liability is the calculated based off the amount of depreciation available to take over the period of ownership – referred to as accumulated depreciation. Based off the above scenario, this amount is $750,000.

Step 4: Determine Your Filing Status

Your income, tax filing status, the state where you pay income taxes, and the location of the property will determine your capital gains tax rate. The IRS, most state governments, and some local governments collect a capital gains tax on the sale of an investment property, compounding the rate and increasing your tax bill.

At the federal level, the capital gains tax rate is 0% for investors with an annual income (including the gain resulting from asset sales) less than $40,000 per year; 15% for investors with an annual income from $40,001 to $441,450; and 20% for investors with an annual income above $441,451. Most state tax authorities collect a capital gains tax as well. The state tax rate ranges from 0% to 13.3%. California is at the top of the list with a 13.3% capital gains tax rate, while some states, like Texas, Washington, and Florida do not collect state capital gains taxes.

Step 5: Calculate the Capital Gains Tax

Capital gains taxes are applied to the taxable gain based on the tax rate determined by your income and filing status, and the bill can be significant. There are four property tax categories: federal capital gains taxes, state and local capital gains tax, depreciation recapture, and net investment tax.

The federal and state capital gains taxes are calculated at the investor’s tax rate on the taxable gain. In our example above, a California property owner with a taxable gain of $2,200,000 would owe 20% in federal capital gains tax and 13.3% in state capital gains tax amounting to $732,600 in total capital gains taxes. Individuals with significant investment and rental income may also have an additional 3.8% net investment tax—included as part of the Affordable Care Act—added on top of the capital gains rate. This brings the total capital gains bill in California to 37.1% or $816,200 on the example above. This example is unique to properties and taxpayers located in California, which has the highest capital gains tax rate in the country.

In addition to capital gains taxes, investors will also pay depreciation recapture. Investors take a depreciation deduction on their annual taxes to offset rental income. The depreciation deduction not only decreases the investor’s annual tax liability, it also decreases the remaining tax basis for the property. Once you sell the asset for a profit, you must pay back those deductions. This is depreciation recapture. The rate of tax on depreciation recapture is a flat rate of 25% at the federal level, can also include up to 13.3% state income tax, and be subject to net investment income tax for an additional 3.8%. While capital gains tax is based on the taxable gain, depreciation recapture is calculated based on the accumulated depreciation during the investor’s ownership. Based off $750,000 of accumulated depreciation, the depreciation recapture tax in this scenario could be as high as $315,750.

Deferring Capital Gains Tax with a 1031 Exchange

Real estate investors have the opportunity to defer, reduce, and even eliminate paying capital gains taxes by performing a 1031 Exchange, also known as a “like-kind” exchange. A 1031 Exchange, named for Section 1031 of the U.S. Internal Revenue Code, is a transaction approved by the IRS, which allows real estate investors to defer the tax liability on the sale of investment property. To defer the capital gains tax on the proceeds of investment property, investors must reinvest their sales proceeds into like-kind investment property of equal or greater value. Like-kind is defined by the IRS as any real estate of the same nature or class, not of the same quality or property type. Generally, this means that you can exchange any investment real estate asset—not a personal residence—for another investment real estate asset. For more information on 1031 Exchanges, download our free guide, “Understanding 1031 Exchanges” by visiting www.re-transition.com/sfaa.

The Rules for 1031 Exchange

A 1031 Exchange can be an excellent tool to defer capital gains, depreciation recapture and net investment income taxes following the sale of an asset, but they can also be complicated transactions. While 1031 Exchanges are flexible in the number of strategies that can be implemented, the rules put forward by the IRS are not flexible. Failure to adhere to IRS rules can result in either a failed Exchange, in which the entire tax liability is due or a Partial Exchange, in which a portion of the tax liability is due (generally the most expensive portion). Prior to the sale of investment property, investors considering an exchange should become familiar with how 1031 Exchanges work and the following primary rules:

- The exchange must be set up before a sale occurs

- The exchange must be for like-kind property

- The exchange property must be of equal or greater value

- The property owner must pay capital gains and/or depreciation recapture tax on “boot”

- The taxpayer that sold and acquired the exchange property must be the same

- The property owner has 45 days following the sale to identify replacement properties

- The property owner has 180 days following the sale to complete the exchange

Improving Cash Flow Potential with a 1031 Exchange*

In addition to tax savings, a 1031 Exchange can improve the potential for cash-flow and appreciation by allowing the proceeds to be reinvested. In our example, the investor’s total tax liability would be $1,131,950. If the post-tax proceeds of $2,118,050 were reinvested and earning a 5% return, this would generate $105,903 in annual income. However, by performing a 1031 Exchange, the investor would have $3,250,000 to reinvest. At the same return of 5%, the exchange proceeds would generate annual cash flow of $162,500. The difference in cash flow potential of over $56,500 represents one of the primary benefits of 1031 Exchanges – the ability to keep all your equity working for you to generate income and appreciation.

* Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options

Austin Bowlin, CPA is a Partner at Real Estate Transition Solutions. As a licensed 1031 Exchange Advisor, Austin helps investment property owners navigate and execute 1031 Exchanges and Delaware Statutory Trusts (DSTs) investments. To schedule a free consultation call 888-755-8595.

If you are considering a 1031 Exchange and would like to understand your tax liability, contact Real Estate Transition Solutions to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors. Our consultations can be done over the phone, via web meeting, or in person at one of our offices. To schedule your free consultation, call 415-691-6525, email info@re-transition.com, or visit https://www.re-transition.com/free-1031-consultation/

About Real Estate Transition Solutions

Real Estate Transition Solutions is an advisory firm specializing in tax-deferred 1031 Exchange strategies, Delaware Statutory Trust investments, and fractional replacement property options. For over 20 years, we’ve helped investment property owners perform successful 1031 Exchanges by developing and implementing well planned, tax-efficient transition strategies carefully designed to meet their financial & lifestyle objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire Exchange process and help you select and acquire 1031 replacement properties best suited to meet your goals. To learn more about Real Estate Transition Solutions, visit our website at www.re-transition.com.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.