Property Performance Metrics: Return on Investment vs. Return on Equity

Quality data is the cornerstone of effective decision making. While it is rarely possible to have perfect information, especially regarding future projections such as how long our current market cycle will last, owners can and should have a firm grasp of both their properties’ current and historic operating data.We work regularly with owners who are considering transitioning their properties for a myriad of reasons. In today’s market many owners are motivated to transition due to: the market cycle, the increasingly difficult regulatory environment, their own personal lifestyle choices, elimination of active management, and/or a desire to improve current cash flow. All these factors are legitimate considerations that we take into account when developing a transition plan. However, many of these factors are personal decisions and others, such as what new rental regulation may be passed in the coming 2-5 years, are difficult to predict with any level of certainty. That being said, property performance metrics are grounded in verifiable data and should be given sufficient attention.

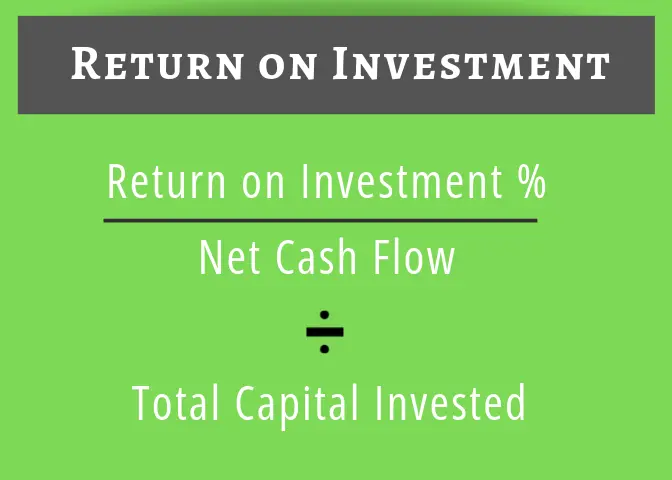

When considering a transition of the property through either a sale and tax-deferred 1031 Exchange or a sale and payment of the associated tax liability, this metric falls short because the appreciation many investment properties have enjoyed over the past 5, 10, and 20+ years is not considered. To capture the property’s appreciation and compare replacement property options, we must turn to the Return on Equity metric.

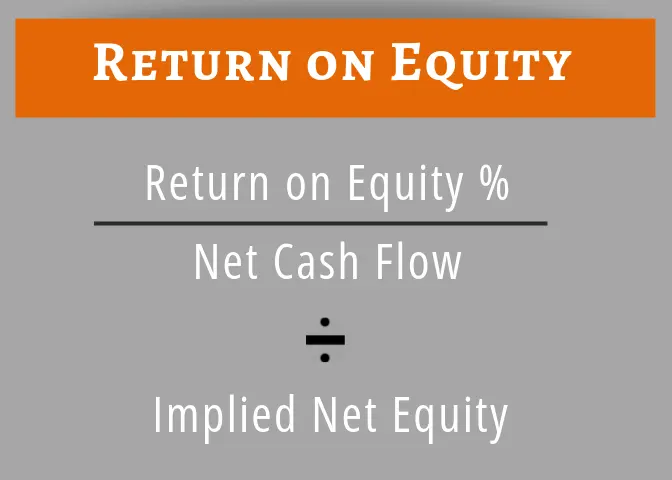

Return on Equity is calculated by comparing the earlier defined net cash flow to the implied equity held within the property. Determining the implied equity of a property requires the owner have a good pulse on the current fair market value of their property. There are multiple ways to determine this value, an overview of which warrants an article on its own. Once a value has been determined, the outstanding mortgage balance and projected closing costs are deducted to arrive at implied equity. The current net cash flow is expressed as a percentage of the implied net equity, resulting in the property’s ROE. This metric is critical for comparing the cash flow to what could be achieved were the property to be sold and 1031 exchanged.

Since many investment properties have appreciated at a faster rate than the properties’ rents and net cash flow, it is not uncommon for investment properties to produce ROEs ranging from 2.5% – 3.5%.* If cash flow is a priority to an owner, they may want to consider 1031 Exchange replacement property options that improve their current potential income such as Delaware Statutory Trusts (for an overview of Delaware Statutory Trusts, download our FREE Guide: Investing in Delaware Statutory Trusts). If you are interested in learning more about these important property performance metrics as they relate to your property and what other options are available that may improve the current cash flow you receive, feel free to contact us.

For more information on 1031 Exchanges and Delaware Statutory Trusts, visit our website at www.re-transition.com and download our FREE Guide: Understanding 1031 Exchanges.

Roger W. Bowlin, Founding Partner at Real Estate Transition Solutions, provides exit strategy analysis, execution, income and equity replacement options for investment property owners. If you have questions relating to your investment property ownership, you can email him at info@re-transition.com or call (206) 686-2211.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options