Table of Contents

A 721 Exchange (UpREIT) enables the conversion of investment property into interest in a REIT. This guide covers how 721 Exchanges work, what kind of properties are eligible, and how DSTs can make this tool more accessible.

Just like how a 1031 Exchange allows a tax-deferred way to convert one investment property into another, a 721 Exchange (UpREIT) enables the exchange of investment property into interest in a Real Estate Investment Trust (REIT). In addition to the tax advantages, this strategy can offer increased diversification, passive income, and liquidity versus holding fee-simple investment property outright.

721 Exchanges are a great tool to be familiar with, but they’re not for everyone. Before diving into the pros and cons of UpREITs and how they work, it’s helpful to take a look what type of properties qualify for this type of exchange.

Qualifying Properties for a 721 Exchange

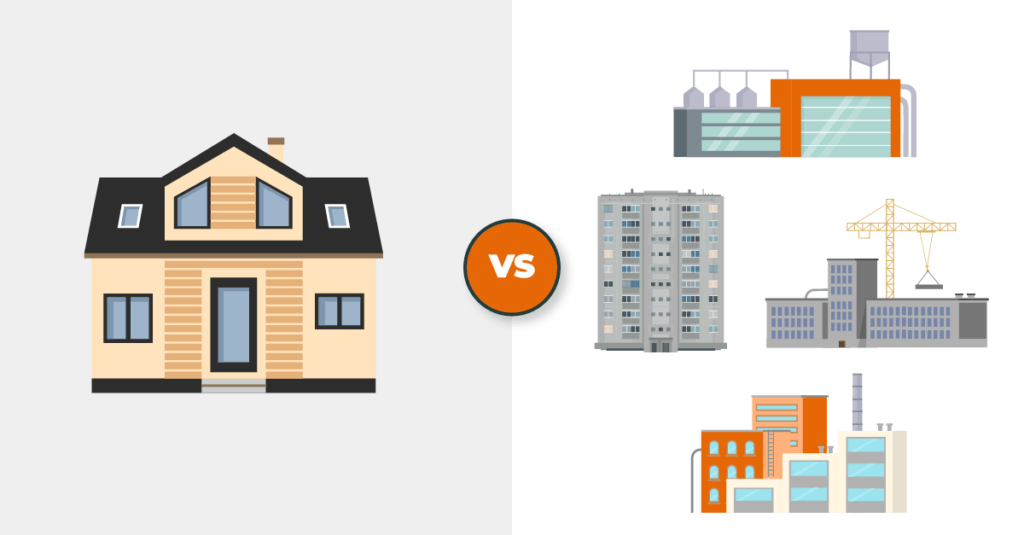

Investors typically need to exchange institutional-grade property to be eligible for a 721 Exchange. While not a precisely defined term, an “institutional-grade”, “high-grade”, or “institutional-quality” property generally refers to a property of sufficient size and stature to merit attention from large national or international investors.

Institutional-grade properties are a requirement for a 721 Exchange because they are the type of properties which REITs are interested in adding to their portfolios. Eligible properties could be an industrial warehouse, a large multifamily complex, a net lease retail building, or other types of commercial real estate.

For investment real estate owners who do not have a stake in institutional-grade property, the 721 Exchange route is still possible through the use of a Delaware Statutory Trust (DST). With a DST, owners of non-institutional-grade property can use a 1031 Exchange to transition their property into a fractional interest in UpREIT-eligible property. Later we will delve into this process in greater depth, but first let’s explore an overview of the potential benefits and disadvantages of using a 721 Exchange.

Pros and Cons of a 721 Exchange (UpREIT)

Exchanging fee-simple property for interest in a REIT has potential benefits and drawbacks that are important to be aware of.

Advantages of a 721 Exchange

Tax Deferral – Just like with a 1031 Exchange, an investor can defer the capital gains taxes incurred from the sale of real property at the time of the transaction through a 721 Exchange.

Increased Liquidity – REITs commonly provide their shareholders with cash distributions, some of which may be tax deferred.

Diversification – REITs generally own a diverse portfolio of properties, further diversifying an investor’s holdings beyond the exchanged property.

Disadvantages of a 721 Exchange

Complexity – The process of transitioning from a fee-simple property to interest in a REIT can be complex, requiring careful tax planning and guidance. Working with a Licensed 1031 Exchange Advisor, along with a tax professional, is recommended to help you navigate this process.

How to 721 Exchange Non-Institutional Real Estate

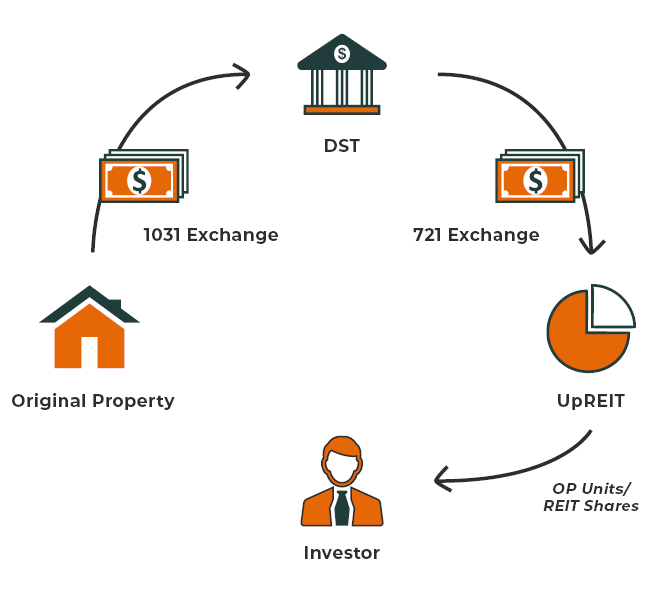

By integrating 1031 Exchanges, DSTs, and 721 UpREITs, investors can convert their portfolios from active, direct property ownership into ownership of shares in a REIT. Let’s dive into how this process works and then explore the pros and cons of this approach.

From Fee Simple to Flexible

Real estate investors typically start with direct, or fee simple, property ownership. When they opt for a 1031 Exchange, they can defer taxes on capital gains by reinvesting the proceeds into other real estate investments, including DSTs. Exchanging into a DST enables investors to transition from fee simple ownership to fractional ownership of institutional-grade investment properties.

Transitioning to UpREITs

The institutional-grade properties contained in DSTs are attractive to many REITs, which is why the UpREIT option becomes possible at this stage. Shares in the DST can be exchanged for Operating Partnership (OP) units in an Umbrella Partnership Real Estate Investment Trust (UpREIT), which is the entity that facilitates the 721 Exchange process. These OP units can later be converted into shares in the REIT.

REITs 101

Real Estate Investment Trusts (REITs) are a popular investment vehicle that provides individuals the opportunity to acquire ownership in institutional-grade properties. These trusts were established by Congress in 1960 and have since democratized access to high-quality, large-scale properties, previously accessible only to entities like pension plans and life insurance companies. Typically, these properties range from $30 million to $300 million in value.

A REIT is a trust structure with preferential tax treatment, contingent on meeting specific requirements, including a limitation on assets not directly related to real estate or debt instruments associated with real estate. A key feature of REITs is the requirement for prompt distribution of cash flow to investors, usually within 90 days of earnings.

The structure of REITs allows pooled investments from multiple investors to acquire and manage large properties, distributing rental income back to investors. Unlike a C corporation, REITs have no corporate income tax applied, functioning as pass-through entities. Investors in REITs pay tax at their marginal income tax rate and can also benefit from depreciation.

The Three Primary REIT Types

- Publicly Traded REITs are listed on stock exchanges and are known for their liquidity and market-driven pricing. These REITs often have high correlation with the overall stock market.

- Private REITs: These usually have a defined investment duration and are characterized by a lack of redemption requests, providing the sponsor flexibility in managing the assets over the investment term.

- Public Non-Traded REITs are regulated by the SEC like Public REITs, but are not listed on exchanges and therefore have less correlation with the stock market. They are usually sold through broker-dealers.

REITs offer several benefits, including diversification, potential for continuous income, and preferential tax treatment. However, they also come with considerations like relinquishing management control, potential changes in tax laws, and limitations on liquidity under certain market conditions. A unique feature of REITs is the 721 UpREIT transaction, which allows tax deferral when an entity absorbs an asset in exchange for ownership. Although direct exchanges into REITs are typically not permitted, one can indirectly participate through a Delaware Statutory Trust (DST) that engages in a 721 UpREIT transaction.

Hardwired vs. Hybrid UpREITs

UpREITs come in two versions: hardwired and hybrid:

- Hardwired UpREITs: In this structure, a typical holding period for the Delaware Statutory Trust (DST) is around two years, after which all investors who have exchanged into the DST are mandatorily included in the UpREIT transaction. This means that upon the end of the hold period, their investment in the DST is converted into ownership in the REIT. This structure is more rigid, offering less flexibility to investors but providing a straightforward path to REIT participation. The decision to participate in a Hardwired UpREIT is made at the time of investing in the DST, and once in the REIT, investors cannot perform another 1031 Exchange.

- Hybrid UpREITs: The Hybrid UpREIT structure is more flexible, with an average hold period ranging from three to five years. This structure allows investors to defer the UpREIT decision, providing an opportunity to perform another exchange or to opt into the REIT at a later stage.

Decision Factors for Investors

When considering an UpREIT, investors should evaluate their long-term goals and how these align with the benefits and risks of holding interest in a REIT. Here are some of the factors you should consider when evaluating whether a 721 Exchange is right for you:

Access to Liquidity: UpREIT-enabled DSTs can offer faster access to liquidity than traditional DSTs, often in two years rather than 5-10.

Diversification: If your priority is to preserve capital, a more diversified portfolio can help. REITs often hold a highly diversified mix of real estate assets, including debt instruments such as loans.

Estate Planning: 721 Exchanges are often used to distribute assets to beneficiaries. REIT shares are easily divisible and the faster access to liquidity is beneficial to some estate planning situations. Since REIT shares are no longer eligible for further 1031 Exchanges, we will often see the 721 Exchange option used as the last exchange after a series of DST renewals.

721 UpREIT Example

Elizabeth, who had successfully managed her direct property investments over the years, sought a more efficient method for transferring her estate to her beneficiaries. Her objective was to transition into a Real Estate Investment Trust (REIT) without enduring the tax liabilities associated with outright property sales. Her strategic approach involved utilizing a Delaware Statutory Trust (DST) as an intermediary. By engaging in a 1031 Exchange, Elizabeth transferred her properties into the DST, effectively deferring taxes and enjoying this form of passive investment.

The DST played a critical role in Elizabeth’s broader strategy, which ultimately led to an UpREIT. Upon the DST’s integration into the REIT, Elizabeth received Operating Partnership (OP) units. This maneuver allowed her to benefit from the diversified nature of a REIT while maintaining advantageous tax conditions.

Upon Elizabeth’s passing, her beneficiaries inherited the OP units, now valued at a stepped-up basis, which substantially reduced their capital gains tax obligations. In this case, her beneficiaries had the option to sell these units in just two years, accessing liquidity sooner than would be possible in a traditional DST. This inheritance provided them with the benefits of REIT investment minus the direct challenges of property management, thus fulfilling Elizabeth’s vision for a streamlined legacy transition through her astute use of a DST and UpREIT.

721 Exchange (UpREIT) FAQs

A 721 UpREIT facilitates the tax-advantaged exchange of property into a shares in a REIT, whereas a 1031 Exchange facilitates like-kind property exchanges (including DSTs).

UpREITs are designed for accredited investors who meet specific financial criteria, ensuring they have the requisite financial acumen and resources to understand and bear the risks of such investments.

Accredited investors are individuals with a net worth exceeding $1 million, excluding the value of their primary residence, or those with an annual income over $200,000 (or $300,000 for joint income) for the last two years with the expectation of earning the same or higher income in the current year.

Exiting an UpREIT involves converting OP units into REIT shares, which can be sold on the open market. However, this conversion and subsequent sale may trigger tax implications that should be carefully considered.

The primary tax benefit of a 721 UpREIT transaction is the deferral of capital gains tax on the exchange of real estate for OP units. However, eventual conversion of these units to REIT shares or other dispositions may result in tax liabilities.

Evaluating a 721 UpREIT’s suitability involves assessing your investment goals, liquidity needs, tax considerations, and appetite for diversification. Consulting with a financial or exchange advisor is crucial to navigate these considerations.

721 UpREIT opportunities are typically offered through companies specializing in real estate investments, financial advisors, or firms that provide comprehensive estate and tax planning services. The Licensed Exchange Advisors at Real Estate Transition Solutions (RETS) can help you find 721 Exchange opportunities.

Speak with a Licensed Exchange Advisor

Navigating the complexities of 1031 Exchanges, DSTs, and UpREITs requires expert guidance. If you’re a real estate investor with questions about 721 Exchanges, DSTs, or estate planning, contact Real Estate Transition Solutions to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors.

Our free consultations can be done over the phone, via web meeting, or in person at our offices located in Seattle, WA and throughout the West Coast. To schedule your free consultation, call 888-755-8595, email info@re-transition.com, or book directly with an Advisor online.

About Real Estate Transition Solutions

Real Estate Transition Solutions (RETS) is a consulting firm specializing in tax-deferred 1031 Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about 1031 Exchanges and Real Estate Transition Solutions, visit re-transition.com or call us at 888-755-8595.