1031 Exchange Case Study: Seattle Couple Defers $734K in Taxes,

Boosts Annual Income by 64%

- By Austin Bowlin, CPA

- July 17, 2025

Table of Contents

Real Estate Transition Solutions (RETS) guided Seattle retirees Robert and Lily through a successful 1031 Exchange from a single apartment building into a diversified Delaware Statutory Trust (DST) portfolio. The exchange allowed them to defer taxes, increase annual income, gain new depreciation benefits, and eliminate the burden of active property management, ultimately optimizing their investment strategy to support their retirement goals.

Case Study Snapshot

Meet Robert and Lily

Seeking retirement after three decades of active property management, Washington couple Robert and Lily were ready to sell their 10-unit apartment building they purchased in 1992 for $850,000 to diversify their portfolio to support their retirement objectives.

-

Relinquished Properties

10-Unit Apartment Building

-

Location of Properties

Seattle, Washington

-

Exchange Proceeds

$3,008,000

-

Exchange Objectives

Defer Significant Tax Liability

Establish New Depreciation Shelter

Maintain Steady Income Stream for Retirement

Eliminate Management Responsibility

Diversify to Higher-Quality Institutional Property

-

Replacement Properties

Multi-Sector Portfolio of DST Properties

Background and Opportunity

After more than 30 years of ownership and management, Robert and Lily were ready to retire. The property had appreciated substantially and was fully depreciated, leaving them with a large potential tax liability upon sale.

Calculating 1031 Exchange Tax-Deferral Savings

The total tax liability from the sale of investment real estate located in WA includes:

- Federal Capital Gains Tax (15% – 20%)

- Depreciation Recapture (25%)

- Net Investment Income Tax (3.8%)

By performing for a 1031 Exchange, they were able to defer a total of $733,924 in taxes.

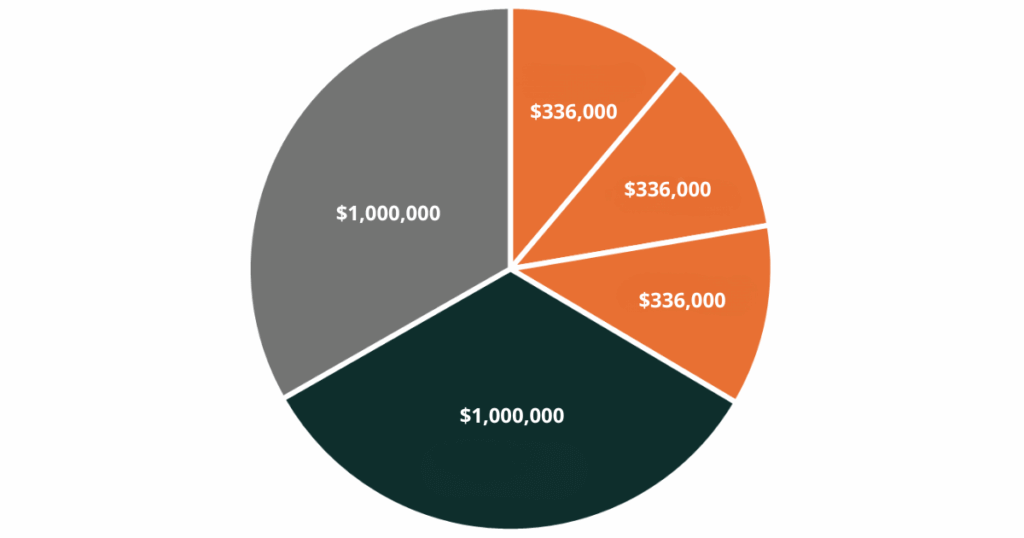

1031 DST Exchange Strategy

To address the clients’ objectives, RETS designed a diversified portfolio of DST replacement properties. The institutional-grade properties, properties of sufficient size and stature typically reserved for large national or international investors, were diversified by both geographic location and property type. The strategy increased their monthly cash flow, reduced taxable income through fresh depreciation, and removed the responsibility of property management.

The recommended DST portfolio had a blended loan-to-value (LTV) ratio of 48.2%, with non-recourse 10-year fixed-rate financing. By acquiring more property value than needed for full tax deferral, Robert and Lily benefitted from new depreciation, which helped shelter much of the income from taxes.

Exchange Goals Achieved

By performing a 1031 Exchange into DST real estate, Robert and Lily:

- Deferred $733,924 in capital gains and depreciation recapture taxes

- Completely eliminated management responsibilities

- Diversified across multiple institutional-grade assets

- Increased their annual income to $151,900

- Reduced their taxable income to $41,900 through new depreciation

A 1031 Exchange into DSTs can be an ideal solution for owners of appreciated investment real estate who wish to transition out of active management. DST portfolios can be customized to meet an individual’s financial, lifestyle, and tax-planning goals.

*Client examples are hypothetical and for illustration purposes only. Individual results may vary.

Speak with a Licensed Exchange Advisor

Navigating the complexities of 1031 Exchanges, DSTs, and UpREITs requires expert guidance. If you are an investment real estate owner with questions about 721 UpREIT Exchanges, DSTs, or estate planning, contact Real Estate Transition Solutions (RETS) to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors.

One of the aspects that sets RETS apart is our rigorous approach to due diligence. This process involves a thorough analysis of financial performance, market conditions, and potential risks associated with each property. Our team of 1031 Exchange Advisors works closely with you to ensure that every investment aligns perfectly with your financial goals, providing expert guidance and detailed insights every step of the way. This careful, strategic approach to due diligence is fundamental in helping you make informed decisions, safeguarding your investments, and achieving successful outcomes.

Our free consultations can be done over the phone, via web meeting, or in person at our offices located in Seattle, WA and throughout the West Coast. To schedule your free consultation, call 888-755-8595, email info@re-transition.com, or book directly with an Advisor online.

About Real Estate Transition Solutions

Real Estate Transition Solutions (RETS) is a consulting firm specializing in tax-deferred 1031 Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about 1031 Exchanges and Real Estate Transition Solutions, visit re-transition.com or call us at 888-755-8595.