How to Approach Debt When Evaluating 1031 Exchange Options

A conversation we frequently have with clients when evaluating Delaware Statutory Trust (“DST”) 1031 exchange replacement property options is whether they should “assume” more debt than the debt currently on the property they are exchanging. The answer to this question depends on several factors, including the owner’s risk tolerance and personal views on debt. Undeniably, debt does have a certain amount of risk inherent to it, specifically the risk of either losing a property to a lender or a forced sale due to lack of adherence to the mortgage terms such as debt coverage ratios. On the flip side, there are multiple benefits to debt that can serve to enhance one’s investment which we discuss below.

First, debt is traditionally used to enhance an owner’s current cash flow and “leverage returns.” This concept is relatively straightforward and boils down to the fact that if the cost of capital (i.e. interest rate) associated with the debt is lower than the net operating income of the property as a percentage of the acquisition price (i.e. the “cap rate”), then the debt is contributory and there is a positive arbitrage by paying less for your borrowed money than your investment is earning. Additionally, should the property appreciate, all appreciation is attributed to the owner. Therefore, any amount of appreciation on a smaller amount of capital used to purchase the property translates to a greater overall percentage return on investment.

In addition to the first benefit of debt detailed above, it is worth noting that mortgage interest rates are nearly as low as they have ever been in the last 50 years. These rates are unlikely to stay this low into perpetuity. Locking in lower rates with fixed-rate debt could serve to pay dividends down the road.

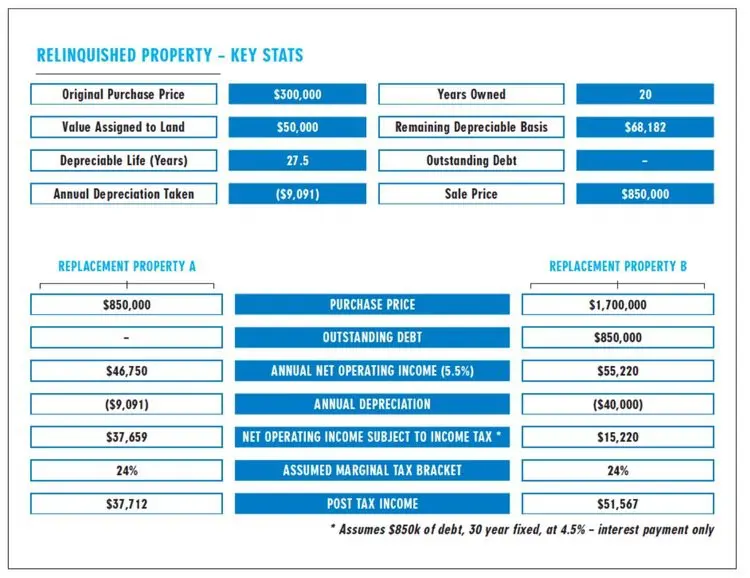

The second significant benefit associated with debt is particularly impactful for owners that have either owned their property for 10+ years or have experienced significant appreciation and thus do not have much depreciable basis (see December 2017 article entitled “What is Basis and How Can I Calculated It”). As an owner’s depreciable basis declines, there is less available depreciation expense to offset the taxes associated with rental income. Exchanging into property with an increased loan-to-value compared to the relinquished property, enables an individual to acquire more depreciable basis without having to contribute additional equity. The depreciable basis will shelter income from taxes, one of the most favorable features of real estate as an asset class. Let’s look at the following example to illustrate this concept:

In the above example, we can see that a property sold for $850k with no debt can be exchanged into a property purchased for $1.7m with 50% loan-to-value and no additional cash contributed – thus simultaneously increasing the overall income potential and reducing the taxable income for a net benefit of nearly $14k per year. The impact of this concept can be significant and can potentially result in both real dollars earned through rental income and real dollars saved by virtue of not having to pay tax on them.

Delaware Statutory Trust replacement properties provide a particularly clean and simple way to deploy the strategy of exchanging up into property with a higher loan-to-value. Because DSTs hold institutional properties and the financing is arranged by the sponsor, the interest rates DSTs pay on their mortgages tend to be lower than that which is available to the individual owner. Additionally, since the debt is fully secured by the property and is non-recourse, lenders cannot ever lay claim on assets outside of the Trust. Coupled with the fact that DSTs are entirely free of the responsibility of active management, they can be utilized to simultaneously increase post-tax income potential while freeing up individual owner’s time.

In conclusion, the appropriate treatment of debt in a tax-deferred 1031 exchange depends on the owner’s objectives and preferences. Due to the fact it presents both risks and rewards, its treatment should be carefully considered and discussed to determine what course of action is most suitable for you.

If you have an issue or a concern relating to your investment property ownership, contact Austin Bowlin, CPA and Partner at Real Estate Transition Solutions to schedule a complimentary consultation. Austin provides exit strategy analysis, execution, income and equity replacement options for investment property owners and can be reached at 206-686-2201 or email him at aabowlin@re-transition.com.

*This article is for informational purposes only and does not constitute tax or legal advice. Your personal advisor should be consulted when making any tax or legal decisions.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is independent of ASI and SAM.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options