2024 Market Outlook for Investment Property

Navigating Through Macroeconomic Impacts and Regulatory Shifts in 2024

2024 Economic Overview

The financial landscape in 2024 is characterized by a sense of cautious optimism. The year-end peak in historic stock prices has set an optimistic tone for the year ahead, indicating a potential for growth and recovery across various sectors. Inflation saw a slight uptick in December, primarily driven by the rising costs of food and shelter but is anticipated to stabilize, aligning with the Federal Reserve’s target rate of around 2%.

Stabilized Interest Rates

Interest rates, a pivotal factor in economic forecasting, are in a state of flux. The Acting Secretary of Labor reports that despite December’s robust job growth, the anticipated interest rate cuts by the Federal Reserve may be delayed, with experts suggesting a more gradual approach throughout the year.

According to Green Street’s Commercial Mortgage Alert, the commercial real estate market is adjusting to these economic winds, with operating fundamentals showing signs of deceleration while maintaining overall health. The inflationary pressures of the past year have impacted real estate values, with both REITs and private real estate witnessing a sharp downturn since 2022. Despite this, there is an expectation that future Net Operating Income (NOI) growth will outpace inflation in the coming years, although the office sector may prove an exception to this trend.

Reduced Recession Fears

The specter of recession, which loomed large in previous forecasts, now appears less threatening. The probability of a recession has decreased from 48% to 39% as per a survey of leading economists, leading to the sentiment that while the economy might experience stagnation, an outright recession is less likely.

In terms of investment volume, there’s a renewed sense of optimism. Industry professionals are forecasting a strong rebound in commercial mortgage-backed securities issuance. This is underpinned by the belief that stabilizing interest rates will catalyze a surge in sales, refinancings, and recapitalizations of commercial properties, indicating a more vigorous market activity as the year progresses.

Decelerating Inflation

Fannie Mae’s Economic and Strategic Research Group points to a modest downturn in 2024, succeeded by a resurgence in growth in 2025, carried by the enduring momentum of jobs and wages. Simultaneously, the Federal Reserve’s outlook, which includes a deceleration in inflation and steadfast unemployment rates, hints at a year where growth is tempered by reality checks.

CRE Debt Markets

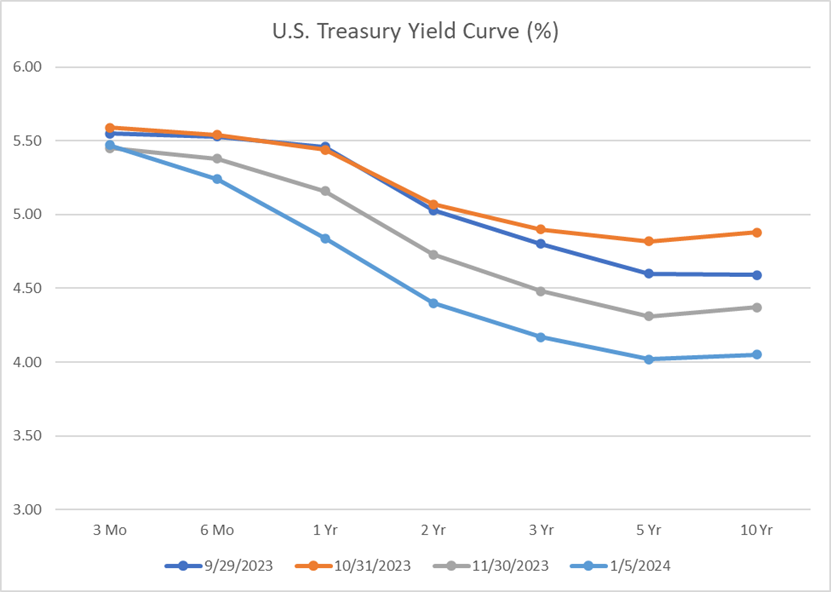

The economic indicators for 2024 suggest a period of balancing acts in the CRE debt markets. While the previous year’s debt has become more accessible and less costly, a cautious upward trend in long-term U.S. Treasury interest rates indicates a maturing phase where borrowers find solace in a stabilizing debt market:

Source: U.S. Department of the Treasury, January 5, 2024

Throughout CRE sectors, the current landscape is molded by lessons from the past and aspirations for stability. Prices are undergoing a normalization process after the spikes of 2021-2022, with CRE sectors like office taking the hardest hits in terms of price declines over the last twelve months. However, the lower, more stable interest rates are fueling a cautious optimism for a resurgence in deal volume for the year ahead.

This juxtaposition of cautious optimism against a backdrop of economic recalibration is defining the tempo for 2024’s CRE debt markets, as investors keep a close eye on fundamentals and cash-on-cash returns, all while bracing for near-term return compression due to decelerating rent growth and increasing expenses.

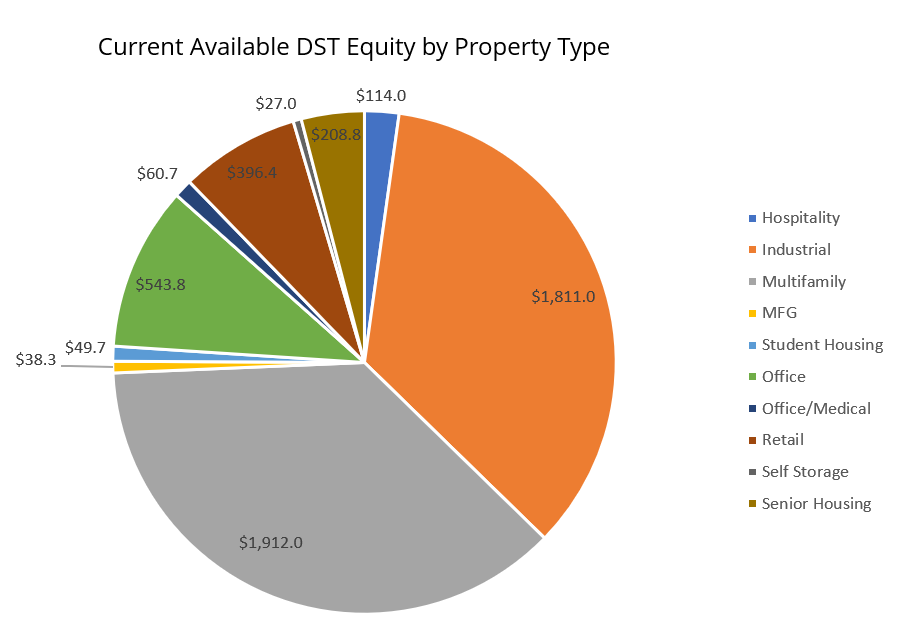

DST Markets

The total year-to-date equity raised in DSTs has reached over $4.6 billion, with multifamily and industrial sectors accounting for the lion’s share of open DST offerings through November 2023, according to research by Mountain Dell Consulting. This investment allocation highlights the enduring allure and resilience of these sectors despite broader market contractions. The 51 active DST sponsors in the market underscore the robust interest and diversity in CRE investment opportunities.

However, not all sectors are faring equally. The office sector continues to struggle with values for high-quality properties declining more than 35% relative to pre-Covid levels. This downtrend is exacerbated by low occupancy, high debt costs, and a scarcity of debt availability for the sector. The Kastle’s Back to Work Barometer, which plummeted during the holidays to less than 24% occupancy in the top 10 cities, underscores the ongoing challenges faced by the office market.

Key CRE Metrics

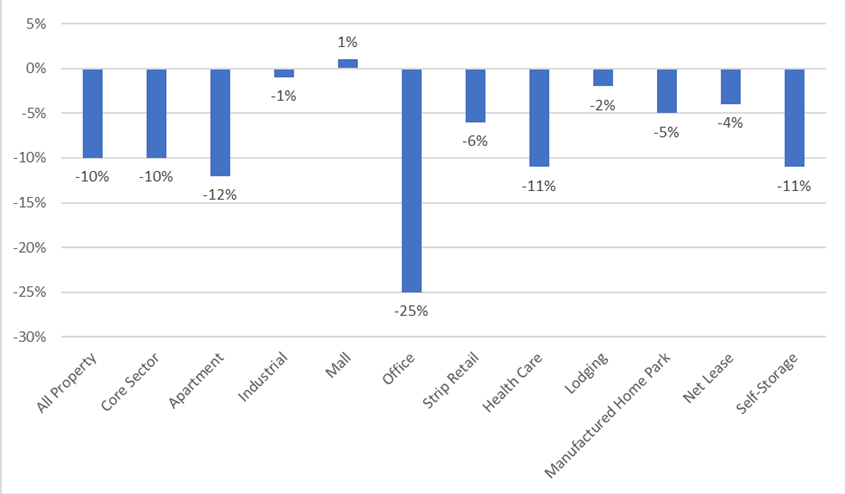

The commercial real estate (CRE) property sectors are experiencing a wave of adjustments as 2024 unfolds. Investment volumes have seen a marked decline across the board, with multifamily and office sectors witnessing a 74% and 70% drop, respectively (Green Street Research, January 2024). These decreases are a reflection of various economic pressures, including rising interest rates, falling rent projections, and an oversupply in certain markets. Despite these challenges, there’s pent-up demand which might result in a bustling 2024 as the market recalibrates to the new norm in interest rates and continues to grapple with a stark undersupply in housing.

12-Month Changes in Commercial Property Values

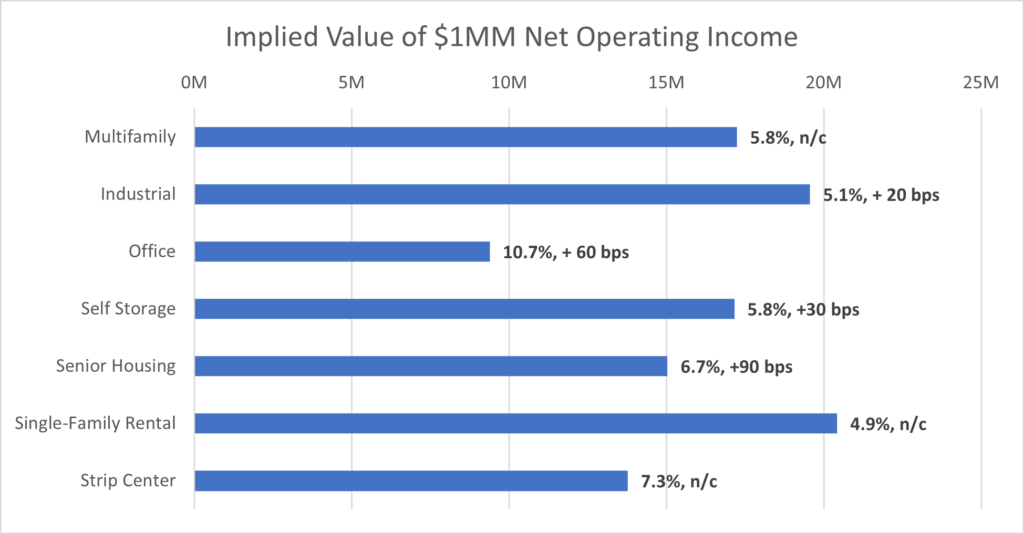

Capitalization Rates by Sector

In terms of sector performance, multifamily has remained relatively strong, with traditional apartments and Single Family Build for Rent trading at the lowest capitalization rates, signifying sustained investor confidence. In contrast, office properties have seen an increase in capitalization rates by 60 basis points, reflecting heightened risk perceptions among investors (Green Street Research, December 2023). These metrics provide crucial insights into the relative attractiveness and perceived risk across different CRE sectors, informing strategic investment decisions as we navigate through the economic recovery.

Top CRE Markets in 2024

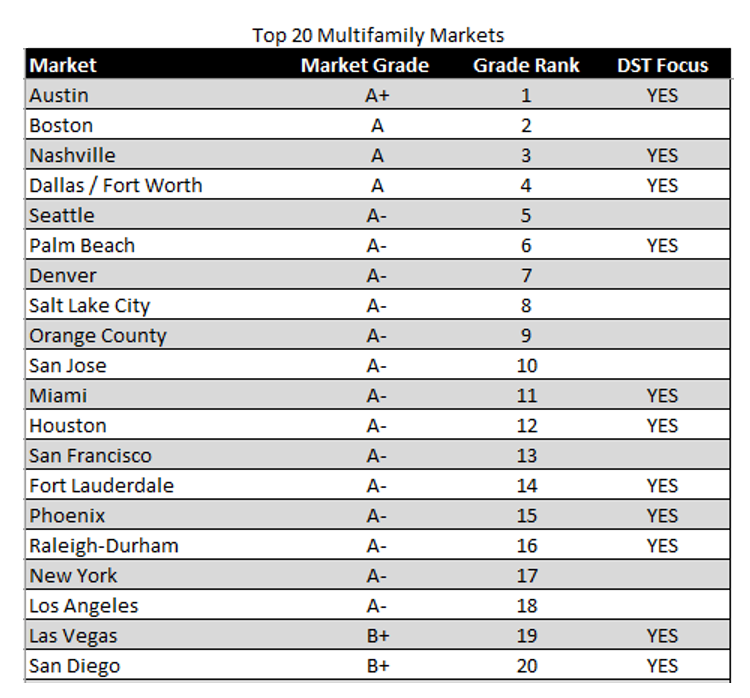

Multifamily

The stark contrast in sales volume across markets, notably in multifamily and retail sectors, illuminates the impact of rising interest rates. Nevertheless, multifamily remains resilient, with strong absorption rates suggesting a rebound in rental rates within the next two years as the current oversupply is expected to meet demand.

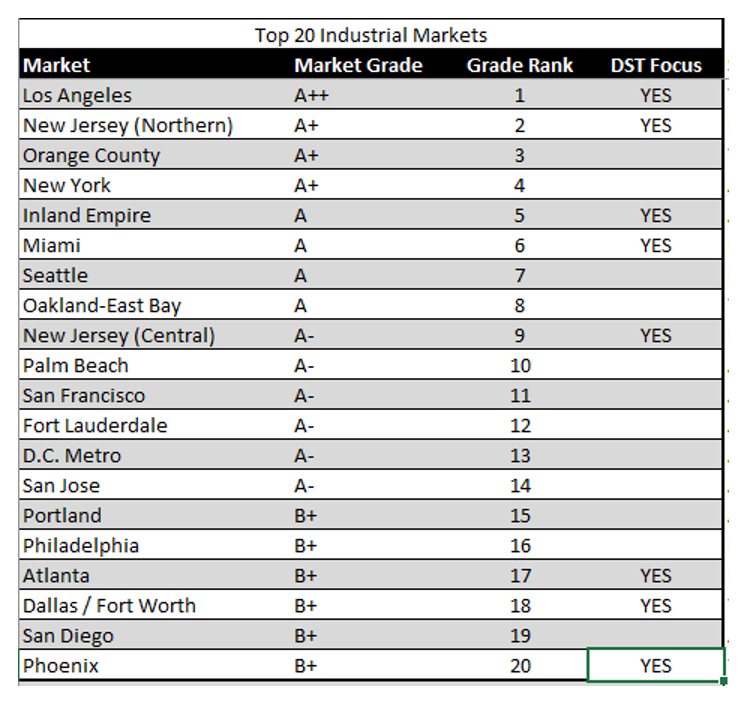

Industrial

Industrial markets tell a varied tale, with the last 12 months leading up to November showcasing both downturns and a few areas of growth. Boston, while not a primary target for DST investment, stands out for its desirability alongside other markets that have drawn significant DST funds. These investments are strategically placed, considering a locale’s fiscal robustness, supply constraints, and business friendliness, particularly concerning property types reliant on robust transportation networks.

Tax and Regulatory Climate

Landlord-Tenant Laws in 2024

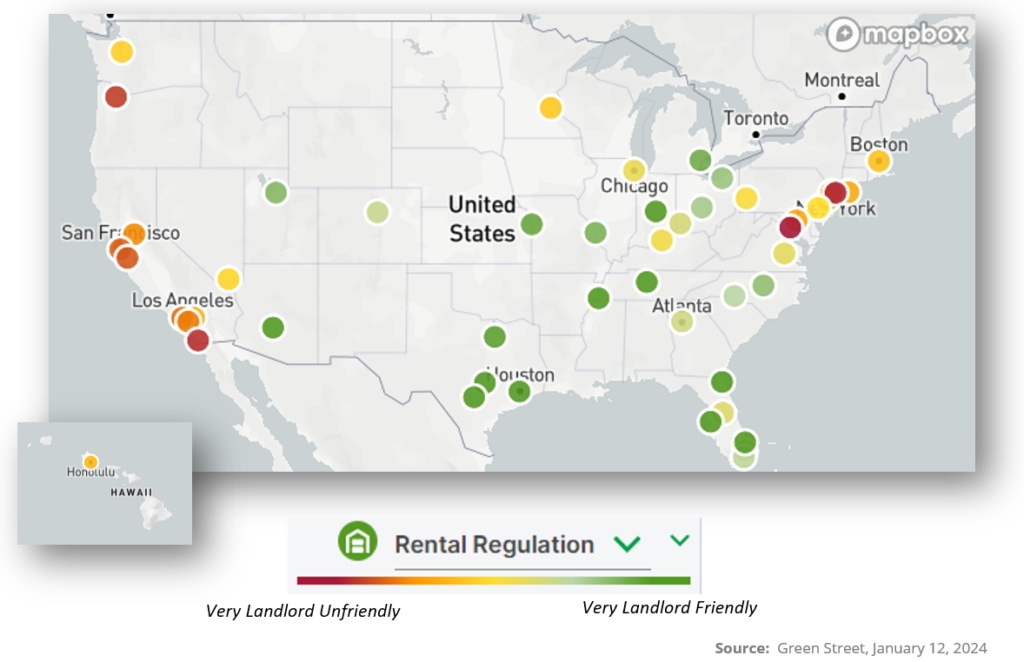

Real estate investment is heavily influenced by the differing landlord-tenant laws throughout the U.S. From eviction rules to rent control, these regulations vary widely and impact property management and investment success. Understanding these laws is vital for landlords to manage their properties efficiently and align with local legal frameworks. The following graphic gives a general overview of the “Landlord Friendliness” of various regions across the country.

Tax Reforms

The looming 2025 expiration of key provisions from the Tax Cuts and Jobs Act signals potential upheaval for real estate investment. With limitations set for state and local tax (SALT) deductions and primary residence mortgage interest deductions, along with adjustments to Qualified Business Income and bonus depreciation deductions, investors are faced with a new fiscal landscape. The White House’s March 2023 budget proposal further complicates the picture, targeting high-earning individuals with increased taxes on net investment income and capital gains, alongside significant changes to 1031 Exchanges and the elimination of the step-up in basis for large inheritances.

Potential Legal Reforms

Despite the absence of substantial momentum for altering 1031 Exchanges, the dialogue is expected to intensify as the 2024 Presidential election approaches. Meanwhile, the lapsing of federal eviction ban moratoriums, with lingering effects at state and local levels, adds another layer of complexity to the rental market. Notably, the End Hedge Fund Control of American Homes Act of 2023 reflects a legislative pushback against institutional investment in single-family residences, mandating the divestment of such assets by funds over the coming decade. This legislative scrutiny comes as investor purchases of single-family homes have marginally decreased from 20% in 2022 to about 15% more recently, indicating a shifting trend in property investment strategies.

Key Takeaways for 2024

- Stabilizing Interest Rates: Volatility in interest rates is subsiding, indicating that major fluctuations are likely in the past, leading to a more predictable economic environment.

- Controlled Inflation: Inflation rates are being effectively managed, suggesting a stable economic climate conducive to investment.

- Industrial and Multifamily Trends: Both industrial and multifamily sectors are showing positive trends, indicating robust areas for investment opportunities.

In wrapping up our outlook, it’s clear that the cyclical nature of commercial real estate often mirrors broader economic trends. Even the most formidable markets are not immune to macroeconomic shifts. Investors seeking stability should look towards resilient property types known for weathering economic fluctuations. Diversification remains a key strategy, not just across property types but also in varying markets and investment timelines.

Delaware Statutory Trusts (DSTs) provide investment real estate owners with options for resilience and diversification, helping to ensure a more stable portfolio that can endure various economic conditions. By factoring in both financial and non-financial goals, DSTs can be tailored to provide peace of mind regardless of the economic weather.

Frequently Asked Questions

While initially it was anticipated that there would be multiple rate decreases starting as early as the first quarter, recent economic data suggests a more conservative approach. Now, it’s expected that there may be only a few rate decreases, potentially beginning in the second quarter, ranging from one to three declines. However, it’s important to note that these rate declines are not the only factor influencing economic conditions. The Federal Reserve’s actions regarding liquidity in the market, through the purchase of bonds like mortgage-backed securities or U.S. treasuries, also play a significant role. Therefore, even with fewer or later rate decreases than previously expected, the overall economic conditions could still improve, and liquidity in the market may increase.

Interest rates have a significant but not perfectly direct impact on property valuations. Generally, when capital becomes less expensive due to lower interest rates, property values tend to improve. This is because the required return on a property does not need to be as high to achieve a targeted return for investors if borrowing costs are lower. In essence, lower interest rates make borrowing more affordable, which can increase the attractiveness and value of properties from an investment perspective.

Currently, it seems unlikely that the regulatory environment for landlord-tenant laws will significantly improve. While some markets, particularly in the Southeast U.S. like Texas, Florida, and the Mid-Atlantic regions including the Carolinas, Virginia, and Maryland, may see tempered changes in these laws, the general trend does not favor a relaxation of regulations. In fact, it is rare to see landlord-tenant laws being repealed or significantly relaxed once they are in place. Therefore, for property owners in regions with aggressive landlord-tenant laws, such as California, Oregon (especially in Multnomah County and the Portland metro area), Washington (particularly Western Washington), New York, New Jersey, and Hawaii, the regulatory environment is not expected to become more favorable. There is little ongoing discussion or movement towards repealing or walking back previously passed landlord-tenant laws.

Speak with a Licensed 1031 Exchange Advisor

If you’re an investment real estate owner with questions about estate planning, DSTs, or executing a 1031 Exchange, contact Real Estate Transition Solutions to schedule a complimentary consultation with one of our licensed 1031 Exchange Advisors. Our free consultations can be done over the phone, via web meeting, or in person at our offices located in Seattle, WA and throughout the West Coast. To schedule your free consultation, call 888-409-5097, email info@re-transition.com, or book directly with an Advisor online.

About Real Estate Transition Solutions

Real Estate Transition Solutions (RETS) is a consulting firm specializing in tax-deferred 1031 Exchange strategies and Delaware Statutory Trust investment property. For over 26 years, we have helped investment property owners perform successful 1031 Exchanges by developing and implementing well-planned, tax-efficient transition plans carefully designed to meet their objectives. Our team of licensed 1031 Exchange Advisors will guide you through the entire process, including help selecting and acquiring passive management replacement properties best suited to meet your objectives. To learn more about 1031 Exchanges and Real Estate Transition Solutions, visit re-transition.com or call us at 888-755-8595.