Understanding DST Structure & Costs

- By Roger Bowlin

- Updated:

There comes a time for most investment property owners when actively managing investment property no longer fits their objectives. We write and consult extensively about various options owners have available to them to eliminate active management, each of which has respective strengths and weaknesses. One popular option for individuals, who prioritize preservation of capital and predictable income potential, is to perform a tax-deferred 1031 exchange into a diversified portfolio of high-quality institutional Delaware Statutory Trust (DST) real estate. The are several benefits associated with exchanging into a portfolio of DSTs (for a refresher, see our article entitled, “Why Consider Exchanging into Delaware Statutory Trusts?”). When discussing DSTs with owners, we regularly hear misconceptions about how DSTs are structured, and the costs associated with the exchange. Below is overview of the structuring process and fee structure:

DST real estate qualifies as “like-kind” for 1031 exchange purposes because the property is specifically identifiable and ownership is considered “direct ownership” by the IRS (see IRS Revenue Ruling 2004-86), even though an investor’s ownership is of a “fractional interest”. National real estate firms, referred to as “DST Sponsors”, use their own balance sheet to acquire the property(s) to be structured within the trust. The acquisition process includes analyzing often hundreds of properties before a select, few offers, are submitted. Even fewer properties will ultimately be placed under contract and eventually acquired. Once acquired, the DST Sponsor will structure the actual trust. The structuring includes the following steps:

- Performing an engineering analysis to determine the useful life of all components of the property (e.g. roof, HVAC systems, parking lot, siding, etc.) and any deferred maintenance that the trust must collect reserves for to fund future expenditures.

- Securing long-term debt (generally 10-year fixed rate debt) for the trust, if applicable.

- Commissioning an independent third-party due diligence report to vet the market and property assumptions as well as the rent and expense growth assumptions used in the financial projections.

- Commissioning a legal and tax opinion from a reputable tax law firm to attest to the fact that the trust will qualify for 1031 exchange purposes.

- Construction of the offering memorandum so that the trust complies with applicable securities law as set forth by the Securities and Exchange Commission (SEC).

- Performance of due diligence by the diligence team of a registered broker-dealer.

Naturally there are costs associated with these steps. The result is that investors can access high-quality institutional investment property that has been professionally underwritten, analyzed and acquired and will be professionally managed. Furthermore, investors can combine multiple DSTs together, creating a customized portfolio that is tailored to their specific objectives. The structuring costs are fixed within the offering. There is one variable cost, the compensation paid to the entity that holds the required securities licenses to transact the DSTs on behalf of an investor.

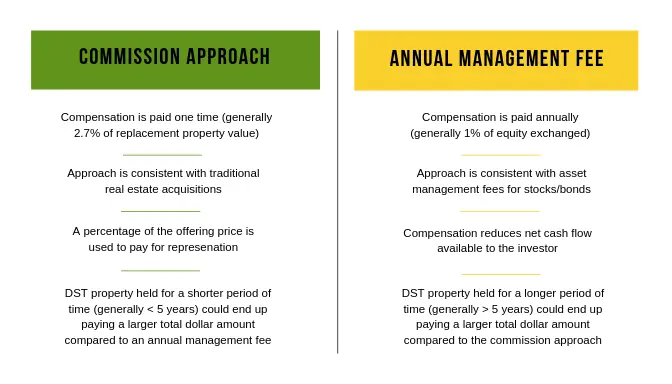

Compensation for DST placement can be structured two different ways. The compensation approach that is best for an investor depends on the investor’s objectives and personal financial situation. Traditionally, representation is compensated through a one-time commission paid by the DST Sponsor to the representative at the time of the exchange. This approach is consistent with the approach most investment property owners are accustomed to when working with commercial real estate brokers. Additionally, the commission amount is consistent with commercial real estate brokerage commissions. The alternative approach is to defer the one-time commission, thus increasing the amount of ownership the investor acquires in the DST property, and instead charging an annual management fee that is taken out of the potential cash flow produced by the DST property. Both options should be available to investors, below is a comparison of each approach.

In our experience, DST real estate is held on average for 6.5 years. Usually this is because the loan prepayment penalties often make it disadvantageous to sell the property within the first few years following the acquisition. Furthermore, if a DST Sponsor is to implement a value-add strategy, the DST Sponsor will need time to improve the property and increase the property’s net operating income to generate a higher potential sales price.

Considering the expected DST hold period and real estate investors’ familiarity with a commission structure for the acquisition of real estate, the commission approach outlined above is utilized by the vast majority of DST investors. Investors should be aware of both compensation approaches and have a conversation with their advisor as to which approach is best for their individual objectives. Due to licensing requirements, some advisors are only allowed to offer one approach. We feel strongly that advisors should operate with complete transparency and offer both approaches to their clients. If your advisor only shares one approach, or is only able to provide one approach, we encourage working with an advisor who has both options available and can provide a solution tailored to your individual needs.

I believe DST ownership is an excellent option for accredited investors looking for full tax deferral, diversification, cash flow potential and no management requirement. Understanding the structure of DSTs is key to making informed decisions. If you are interested in learning more about DST ownership as a tax-deferral strategy, I encourage you to take advantage of one of our many educational resources by scheduling a call or consultation, attending one of our quarterly “1031 Exchange Lunches” or by downloading our free “Guide to Investing in Delaware Statutory Trusts”.

Roger W. Bowlin – Founding Partner of Real Estate Transition Solutions, provides exit strategy analysis, execution, income and equity replacement options for investment property owners. If you have questions relating to your investment property ownership, please email info@re-transition.com or call (206) 686-2211.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Aurora Securities, Inc. (ASI), Member: FINRA/SIPC. Advisory services offered through Secure Asset

Management, LLC (SAM), a Registered Investment Advisor. ASI and SAM are affiliated companies. Real Estate Transition Solutions (RETS) is

independent of ASI and SAM.

- Speak with a licensed 1031 Exchange Advisor

- Discuss your potential tax liability

- Understand benefits vs. risks

- Discuss 1031 Exchange options